Aggressive and Defensive Cash-Secured Put Trades – April 28, 2025

Much like our covered call writing trades, our cash-secured put trades can also be crafted to be aggressive or defensive. Factors to consider include overall market assessment, chart technical indicators, personal risk tolerance and initial time-value return goal ranges. In this article, a real-life example with Shopify, Inc. (Nasdaq: SHOP) will be used to analyze both approaches.

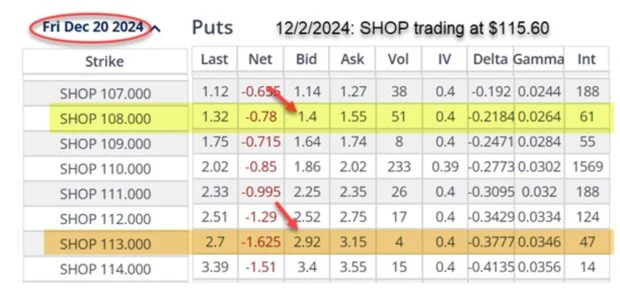

SHOP option-chain on 12/2/2024

- The $113.00 out-of-the-money strike shows a bid price of $2.92 (red arrow, brown cell)- aggressive approach

- The $113.00 strike shows a Delta of 37.7%, meaning an approximate 37.7% probability of expiring in-the-money, something we want to avoid. Let’s call this a 37.7% risk factor

- The $108.00 deeper out-of-the-money put strike shows a bid price of $1.40 (red arrow, yellow cell)- defensive approach

- The $108.00 strike shows a Delta of 21.8%, reflecting a low risk of expiring in-the-money for this strike

- Note the Deltas for puts show minus signs. This is due to the fact that put deltas are inversely related to share price movement

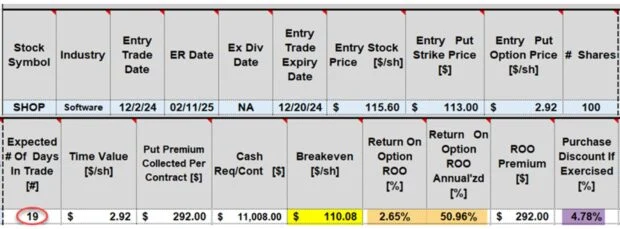

SHOP initial aggressive calculations using the BCI Trade Management Calculator (TMC)

- The TMC shows a 19-day (red circle) return of 2.65%, 50.96% annualized (brown cells)

- The breakeven price is $110.08 (yellow cell)

- If exercised, SHOP would be purchased at a 4.78% discount from the price at trade entry (purple cell)

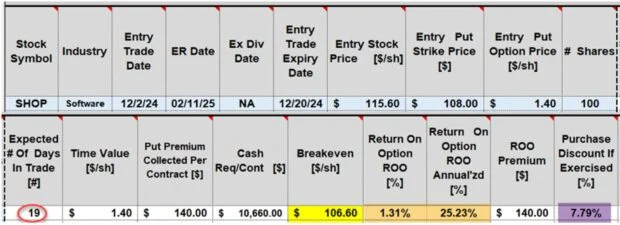

SHOP initial defensive calculations using the BCI Trade Management Calculator (TMC)

- The TMC shows a 19-day (red circle) return of 1.31%,25.23% annualized (brown cells)

- The breakeven price is $106.60 (yellow cell), much lower than the aggressive approach

- If exercised, SHOP would be purchased at a 7.79% discount from the price at trade entry (purple cell)

Discussion

Cash-secured put trades can be constructed to be aggressive or conservative. In the BCI methodology, we favor out-of-the-money (OTM) cash-secured puts. The slightly OTM puts are considered more aggressive and deeper OTM put strikes, more defensive.

Author: Alan Ellman