Calculating Collar Trades Using the BCI Trade Management Calculator (TMC) – May 5, 2025

The Collar Strategy is a covered call writing-like strategy where a protective put is added to the trade, thereby establishing a floor and a ceiling with a maximum gain and a maximum loss. The 3 legs of a collar are an out-of-the-money (OTM) call, an OTM put and a long stock position. This article will use a real-life example with NVDIA Corp. (Nasdaq: NVDA) to demonstrate how to calculate the initial collar returns using the BCI TMC spreadsheet.

Main uses for adding a protective put to convert covered call trades to collar trades

- Protection in a contract period to protect during an earnings report

- Protection during bear & volatile market conditions

- Reducing risk during uncertain times (Brexit, Fed announcement, elections etc.)

- Protecting appreciated stocks

- Insurance when we can’t be near a computer to monitor portfolios

Real-life example with NVDA

- 11/17/2024: Buy 100 x NVDA at $132.67

- 11/17/2024: STO 1 x OTM 12/17/2024 $134.00 call at $5.30 (ceiling)

- 11/17/2024: BTO 1 OTM 12/17/2024 $128.00 put at $3.45 (floor)

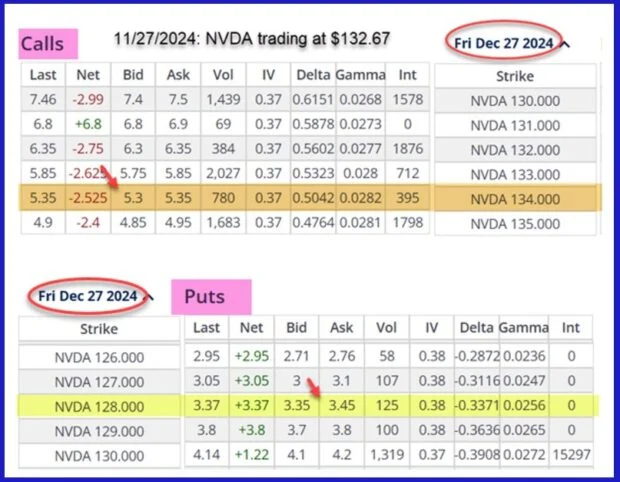

NVDA option-chain on 11/27/2024 for the 12/27/2024 expiration

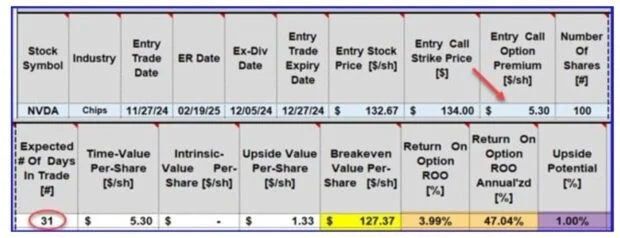

NVDA call returns only: Before protective put purchase

- The entire call premium is entered

- If taken through expiration, this is a 31-day trade (red circle)

- The breakeven price is $127.37 (yellow cell)

- The initial covered call return is 3.99%, 47.04% annualized (brown cells)

- An additional 1% can be realized if the share value moves up to or beyond the $134.00 strike (purple cell)

NVDA Collar Calculations Deducting the Put Debit from the Call Credit ($5.30 – $3.45)

- The net option premium is entered ($5.30 – $3.45 = $1.85)

- If taken through expiration, this is a 31-day trade (red circle)

- The initial covered call return is 1.3%, 16.42% annualized (brown cells)

- An additional 1% can be realized if share value moves up to or beyond the $134.00 strike (purple cell)

NVDA Collar Pros & Cons

- Advantages

–Protects against catastrophic share loss below the $128.00 protective put strike

–Still results in a net option credit with an insurance policy

–Upside potential remains the same (1%)

–Sleep better at night?

- Disadvantages

–Initial time-value return is reduced from 3.99%, 47.04% annualized to 1.39%, 16.42% annualized

Discussion

- The collar strategy adds a protective put to our covered call trades

- Protects us against overwhelming share price decline

- Time-value returns will be lower in exchange for the added protection

- Our collar trades can be managed by the BCI Trade Management Calculator (TMC)

- We do so, by deducting the put premium debit from the call premium credit

- We can establish both initial and final calculations using this spreadsheet

Author: Alan Ellman