Using In-The-Money Covered Calls Around Ex-Dividend Dates – May 19, 2025

A covered call writing strategy commonly used by hedge funds involves using ITM covered call strikes which expire immediately after an ex-dividend date. This may be appropriate only if share retention is not an integral requirement of the strategy. In this article, a real-life example with American Express Co. (NYSE: AXP) will be used to analyze this approach.

What is an ex-dividend date?

This is the latest date a shareholder must own a stock or ETF to be eligible to receive an upcoming dividend distribution. It is also the most common reason for early exercise of a call option (although quite rare).

Proposed strategy

- Buy shares about going ex-dividend

- Sell ITM covered calls that generate a targeted initial time-value return goal range (15% – 30% annualized is a reasonable goal)

- If the option is exercised early and shares sold (typically, the day prior to the ex-date, but rare), the targeted initial time-value return will be realized

- If there is no early exercise, the dividend will also be captured, increasing the final returns, still resulting in a high probability of exercise after contract expiration (assuming no exit strategy intervention)

Real-life example with AXP

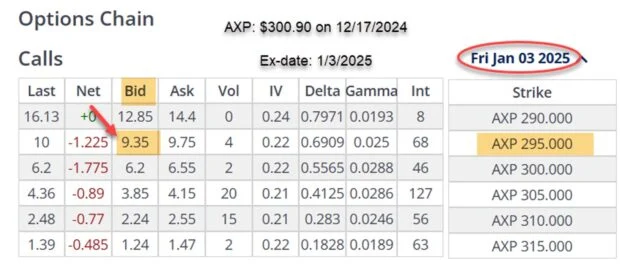

- 12/17/2024: AXP trading at $300.90

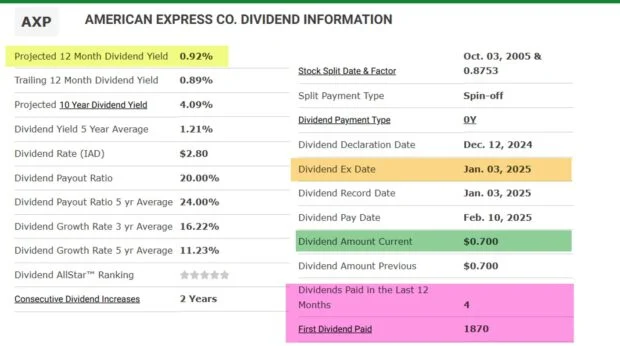

- The ex-date for a $0.70 dividend is 1/3/2025

- The 1/3/2025 $295.00 ITM call strike had a bid price of $9.35

- Targeting an annualized return of 15% -30%

AXP dividend information: www.dividendinvestor.com

AXP option-chain on 12/17/2024

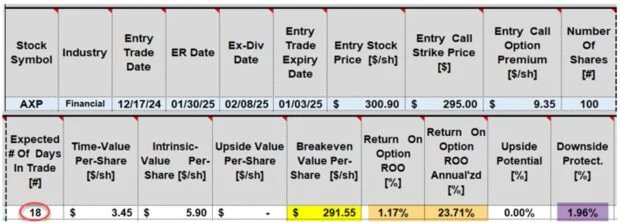

AXP calculations without the $0.70 dividend using the BCI Trade Management Calculator (TMC)

- The spreadsheet shows an 18-day trade, if taken through contract expiration (red circle)

- The breakeven price point is $291.55 (yellow cell)

- The 18-day return is 1.17%, 23.71% annualized (brown cells), aligning with our targeted goal

- The downside protection of the time-value profit is 1.96% (purple cell)

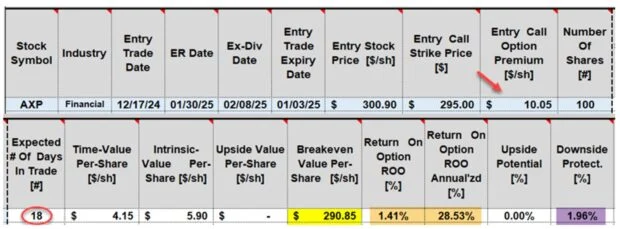

AXP calculations with the $0.70 dividend using the BCI Trade Management Calculator (TMC)

- The spreadsheet shows an 18-day trade, if taken through contract expiration (red circle)

- The breakeven price point is $290.85 (yellow cell)

- The 18-day return is increased to 1.41%, 28.53% annualized (brown cells), aligning with our targeted goal

- The downside protection of the time-value profit is still 1.96% (purple cell)

Discussion

Covered call writing can be used around ex-dividend dates by employing ITM strikes, while setting specific targeted returns. Since exercise is more likely than not, the return will either meet our pre-started goal or do even better if the dividend is also captured. It is critical to also keep in mind that if share price drops below the breakeven price money can be lost and, therefore, we must always be prepared with our exit strategy arsenal.

Author: Alan Ellman