A Real-Life Defensive Weekly Cash-Secured Put Trade with THC + A Sample “Alan Trade” Video – June 9, 2025

Cash-secured put trades can be crafted to be traditional, aggressive or defensive, depending on the degree the put strike is out-of-the-money (OTM). In our BCI methodology, we almost always use OTM put strikes. This article will analyze a weekly defensive put trade with Tenet Healthcare Corp. (NYSE: THC) from 9/16/2024 to 9/20/2024.

Relationship between put strikes and degree of risk (of exercise) inherent in our put trades

- High risk: Very slightly OTM, near-the-money strikes with annualized initial returns > 50% (depending on implied volatility of the underlying security)

- Moderate risk: OTM such that annualized initial returns are approximately between 24% – 48%

- Low risk: Deep OTM put strikes with annualized initial returns between 10% – 20%

Use these percentages as guidelines, not as precise rules.

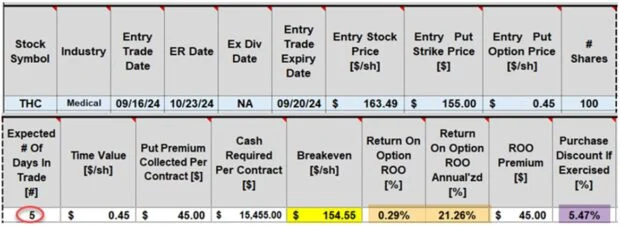

THC data taken from our BCI Weekly Stock Screen and Watch List (9/14/2024)

- THC: $163.49

- Industry: Medical

- Segment rank “A”

- Implied volatility (IV): 29.6%

- Weekly options are not available

- Next ER: 10/23/2024

- No dividend

- On balance volume: Bullish

- Mean analyst rating (MAR) = 1.43 (excellent)

- On BCI Watch List for 16 weeks

- $155.00 (deep) OTM 5-day put strike has a bid price of $0.45

THC initial calculations using the BCI Trade Management Calculator (TMC)

- The 5-day initial time-value return is 0.29%, 21.26% annualized (brown cells), slightly exceeding our goal of 10% – 20%

- The breakeven price point is $154.55 (yellow cell)

- If shares are put to us, it will be at a discount of 5.47% (purple cell) from the price when the trade was executed. This represents our 5-day protection or “insurance policy”

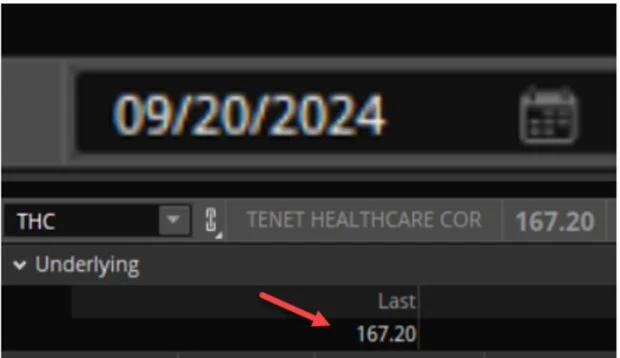

Closing price of THC on expiration Friday

Discussion

THC closed much higher than the deep OTM put strikes ($155.00) and the option expired worthless. This was a successful weekly defensive put trade that represented both low-risk and significant premium returns.

Author: Alan Ellman