Explaining Delta and How to Use it to Craft Our Option Trades – June 30, 2025

Delta is one of the option Greeks. These are mathematical factors that estimate the risk of stock options. We can take advantage of Delta stats when establishing our covered call and put-selling trades.

3 Definitions of Delta

- Delta is the amount an option price will change for every $1.00 change in share price

- Delta is the equivalent number of shares represented by the options position

- Delta is the percentage likelihood that, upon expiration, the option will expire in-the-money (ITM) or with intrinsic value

Practical application

For covered call writing and selling cash-secured puts, assessing the probability of an option expiring ITM is most useful. For example, when writing an out-of-the-money (OTM) call on a stock that we prefer to retain (go unexercised), the Delta, at the time of the trade, will reflect the approximate probability of expiring ITM and subject to exercise. It will quantify the risk inherent in the trade. How much risk are we incurring? Ask Delta!

The same holds true when writing deep OTM cash-secured puts, where we want to avoid exercise and purchasing the underlying shares. The Delta (listed in negative terms, since put premium is inversely related to share price) will also quantify the risk of being subject to exercise. If an option chain strike shows a put Delta of -20, there is approximately a 20% probability of expiring ITM or with intrinsic value. We should also be mindful of the fact that the options can be closed (bought back) prior to contract expiration to avoid exercise.

How is Delta calculated?

Delta stats are based on sophisticated equations inherent in models like the Black-Scholes Model. These mathematical equations for Delta are determined by dividing the change in option value by the change in stock price. Computer algorithms are constantly updating Delta stats and providing them to broker platforms.

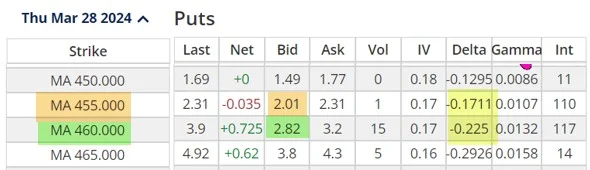

Real-life put trade with Mastercard Inc. (NYSE: MA): $474.74

- With MA trading at $474.74, the probability of avoiding exercise (with no exit strategy intervention) is 17% for the $455.00 OTM put strike and 22.5% for the $460.00 strike

- Bid prices are $2.01 and $2.82 per-share and calculations can be done to determine if they meet our pre-stated initial time-value return goal range.

Real-life ITM call trade with NVDIA Corp. (Nasdaq: NVDA) $121.50

- With NVDA trading at $121.50, the probability of share price falling below the $107.00 ITM strike is 84%, resulting in a risk factor of 16%, based on Delta

- Bid prices is $16.70 per-share and calculations can be done to determine if they meet our pre-stated initial time-value return goal range.

Discussion

Delta is one of the option Greeks that can and should be used to enter and manage our covered call writing and cash-secured put trades when seeking to appraising risk. In addition to quantifying the relationship between stock and option price movement, Delta also defines the risk inherent in the trade as it relates to approximate probability of being subject to exercise.

Author: Alan Ellman