In 54-Days, My Stock Was Up $0.71/Share, but I Made $7.66/Share with Options – June 23, 2025

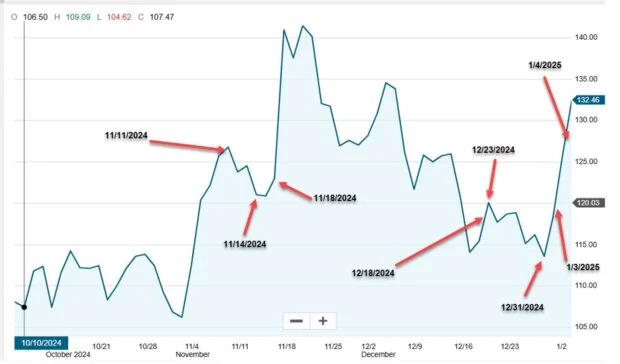

Selling covered calls and cash-secured puts lower our cost-basis and places us in a position to significantly beat the market. Mastering stock selection, option selection and position management are essential in achieving the highest levels of returns. These principles were crystalized with the series of trades, over a 54-day period, John shared with me. The stock used was Vertiv Holdings (NYSE: VRT). Notice how John implemented the 20%/10% guidelines and took advantage of rolling the options down or out.

What are the 20%/10% guidelines for covered call writing?

These are threshold guidelines where to set limit order instructions to our broker as when to buy back the short call if share price declines significantly. It is based on 20% or 10% of the entire original premium and depends on if we are in the first half of a monthly contract (20%) or in the last 2 weeks of a monthly contract (10%). 10% also applies to weekly contracts.

John’s VRT Trades: Overview

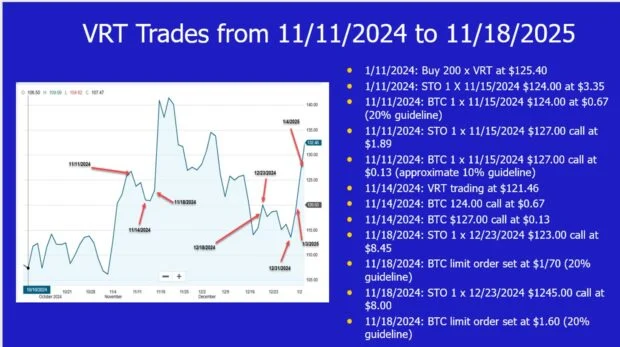

VRT Trades from 11/11/2024 – 11/18/2024

VRT Trades from 12/5/2024 – 1/4/2025

Option credits & debits and share debit

- Option credits total $2915.00

- Option debits total $303.00

- Share loss ($25,080.00 – $24,000.00) = $1080.00

- Net 54-day credit = $1532.00

Final calculations

- $1532.00 on a cost-basis of $25,080.00 represents a 6.1%, 41.29% annualized return

- $1532.00 represents a profit of $7.66/share

- Without options, the return would have been $0.71/share (Closing price of $126.11 – purchase price of $125.40)

Discussion

Selling call and put options conservatively, places us in a position to potentially outperform the market on a consistent basis. Mastering stock and option selection as well as position management will allow us to achieve the highest levels of returns. John’s VRT trades are perfect examples of these possibilities.

Author: Alan Ellman