ITM Calls & OTM Puts: Similar Returns & Breakeven Price Points – July 7, 2025

When seeking a defensive posture to our covered call writing and cash-secured put trades, we use in-the-money (ITM) calls and deep out-of-the-money (OTM) puts. We must always determine our initial time-value return goal range before crafting our trades. Typically, we will find that when the returns for calls and puts are similar, so are the breakeven (BE) price points. For purposes of this article, let’s say we are seeking 2% – 4% per month. A real-life example with DocuSign, Inc. (Nasdaq: DOCU) will be used to view the option-chains and calculate initial returns and BE price points.

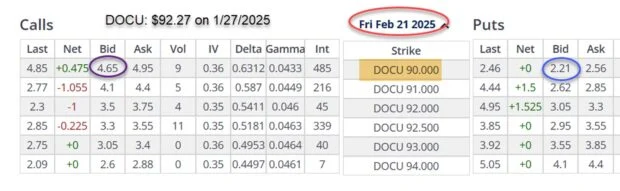

DOCU ($92.27) option-chain on 1/27/2025

- The ITM $90.00 call has a bid price of $4.65 (purple oval)

- The OTM $90.00 put has a bid price of $2.21 (blue oval)

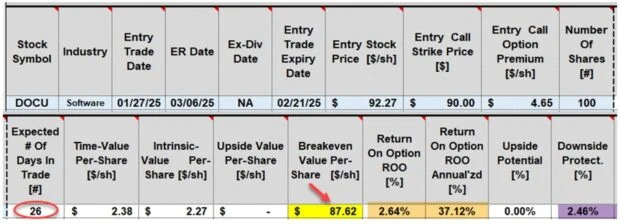

DOCU ITM call calculations: The BCI Trade Management Calculator (TMC)

- The initial time-value 26-day return is 2.64%, 37.12% annualized (brown cells)

- The BE price point is $87.62 (red arrow)

- The downside protection of the time-value profit is 2.46% (purple cell). This is different from protection to BE, which is calculated at 5.0%, [($92.27) – ($87.62)]/$92.27

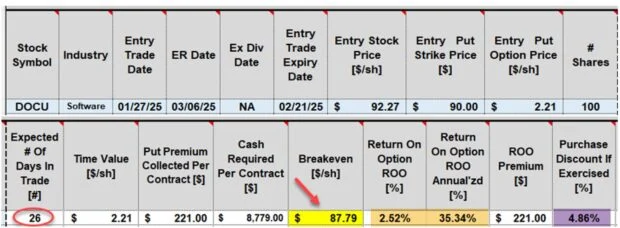

DOCU ITM put calculations

- The initial time-value 26-day return is 2.52%, 35.34% annualized (brown cells)

- The BE price point is $87.79 (red arrow)

- The purchase discount, if exercised is 4.86% (purple cell) This represents protection to BE

Discussion

When pursuing lower risk option trades, we can use OTM puts or ITM calls to lower our breakeven price points. When the time-value returns of these trades are similar, the BE price points will be as well and vice-versa. I give a slight edge to puts when there are serious concerns about short-term market performance, since share purchase will not be required as long as price decline remains above the OTM put strike. We can also implement our exit strategy arsenal to avoid exercise. Both ITM calls and OTM puts are outstanding approaches to hedge against market decline.

*** Adding a protective put is another approach to hedge in bear, volatile and uncertain market conditions. This is known as the collar strategy.

Author: Alan Ellman