Option Greeks as They Apply to Covered Call Writing – July 14, 2025

The option Greeks are financial metrics that are used by traders to evaluate the risk of our option contracts as well as how option price changes as it related to the price of the underlying security. This article will review the option Greeks with an emphasis on the 3 most important to our option trades.

What are Option Greeks?

- Mathematical means of estimating the pricing and risk of our option contracts

- The 5 option Greeks

- –Delta

- –Gamma- 2nd generation Delta, the “Delta” of “Deltas”

- –Theta

- –Vega

- –Rho- not a major Greek

Delta Defined & Applications

- Delta is the amount an option price will change for every $1.00 change in share price

- –How to use the 20%/10% exit strategy guidelines

- –Which strikes to use stock surrogates

- Delta is the equivalent number of shares represented by the options position

- –More for high-wealth portfolio managers

- –Delta-neutral portfolios

- Delta is the percentage likelihood that, upon expiration, the option will expire in-the-money or with intrinsic value (subject to exercise)

- Portfolio overwriting- avoid exercise of low-cost-basis shares

- Deep OTM puts- avoid having shares “put” to us

- Deep ITM calls- avoid stock price dropping below breakeven price point

Theta Defined & Applications

- Estimate of how much the theoretical value of an option will decline with the passage of 1 calendar day

- Assists us in determining when to enter our trades

- Assist us in the most appropriate exit strategies to use

- 20%/10% BTC-GTC limit orders

- “Hitting a Double” versus “rolling-down”

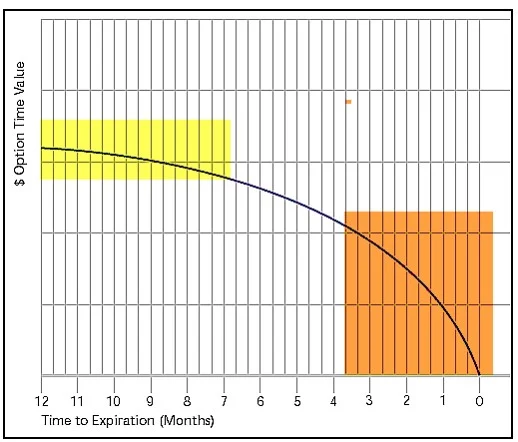

Graphic representation of Theta for near-the-money strikes

There are more opportunities to generate additional time-value profit earlier in the contract before Theta depreciates time-value opportunities.

Vega Defined & Applications

- Amount an option price changes with a 1% change in implied volatility of the underlying security

- Extremely important to integrate implied volatility into our option trading decisions

- IV can also be used to determine an expected trading range for a specific contract

- Greater implied volatility = larger premiums = greater risk to the downside

- IV is inherent in our option time-value components

- Our initial time-value return goal range can be used to measure the risk of our trades

- 2% – 4%/month, for me

- 1/4th that amount for weekly expirations

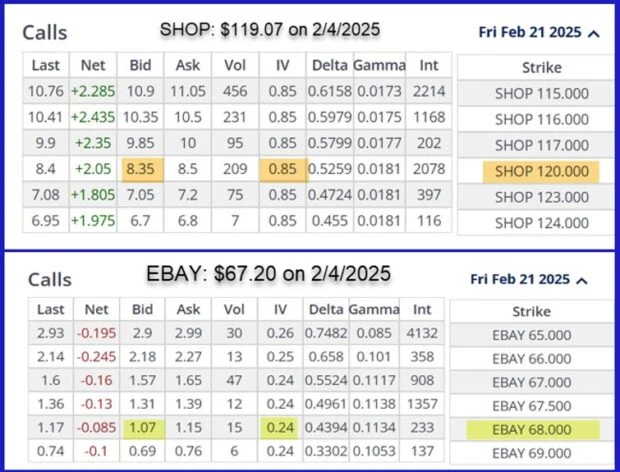

Comparing high-IV (SHOP) with low IV (EBAY) stocks: Option chains on 2/4/2025

SHOP IV is much greater than that of EBAY. Let’s insert the corresponding bid prices into our Trade Management Calculator (TMC).

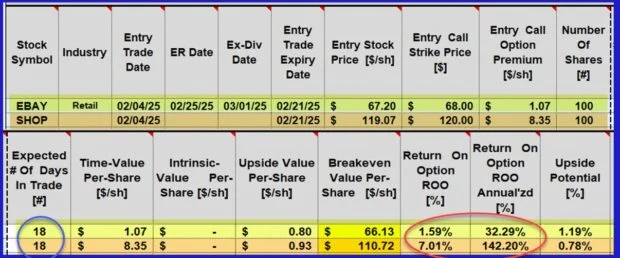

SHOP vs. EBAY initial time-value returns using our Trade Management Calculator (TMC)

- SHOP 18-day return is 7.01%, 142.20% annualized

- EBAY 18-day return is 1.59%, 32.29% annualized

- SHOP is much more tempting, but does the additional risk to the downside align with our personal risk-tolerance? Maybe, yes; maybe, no. This will vary from investor-to-investor

Discussion

- The most important Greeks for covered calls and cash-secured puts are Delta, Theta & Vega

- Premium returns should be measured against the inherent risk in our trades

- The Greeks assist us in entering and managing our trades

Author: Alan Ellman