Selling Calls & Puts with the Same Stock in Mixed Market Conditions – July 28, 2025

Covered call writing and selling cash-secured puts trades can be structured to be more aggressive (out-of-the-money-OTM) covered calls and slightly OTM cash-secured puts or to lean defensive (in-the-money- ITM) covered calls and deep OTM cash-secured puts). I am frequently asked if it is prudent to sell calls and puts on the same underlying security and same expiration date. This article will analyze trades executed with UTI using a more aggressive covered call writing strategy (2 contracts) and a more defensive cash-secured put approach (3 contracts). The 5 contracts sold reflected a mixed market environment where I opted to lean slightly defensive.

A real-life example with Universal Technical Institute, Inc. (NYSE: UTI)

- 3/3/2025: UTI trading at $28.48

- 3/3/2025: The 3/21/2025 $30.00 call had a bid price of $0.48 (aggressive approach)

- 3/3/2025: The 3/21/2025 $25.00 put had a bid price of $0.20 (defensive approach)

Expectations prior to running the calculations

- The covered call trade will offer greater initial and annualized returns

- The covered call trade will offer the potential of a 2nd income stream in the form of share appreciation from current market value, up to the OTM call strike

- The cash-secured put trade offers only 1 income stream potential (barring exit strategy intervention)

- The cash-secured put trade will offer a much lower breakeven price point

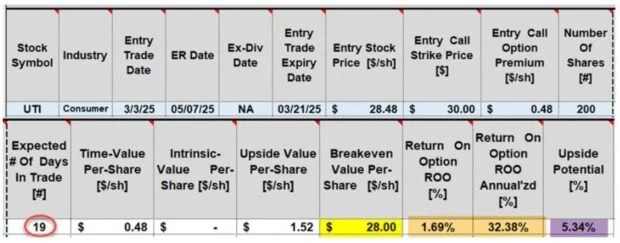

Initial covered call (aggressive) calculations with the BCI Trade Mangement Calculator (TMC)

- Red circle: If taken through expiration, this is a 19-day trade

- Yellow cell: The breakeven price point is $28.00

- Brown cell: The initial time-value return is 1.69%, 32.38% annualized

- Purple cell: There is an additional upside potential of 5.34%, creating the possibility of a 7.03%, 19-day return

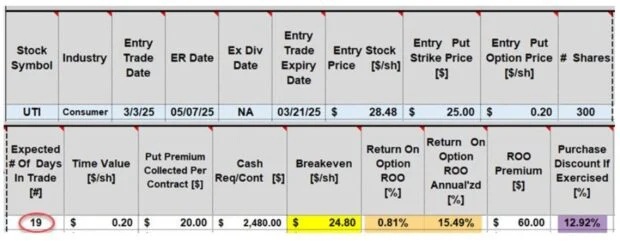

Initial cash-secured put (defensive) calculations with the BCI Trade Mangement Calculator (TMC)

- Red circle: If taken through expiration, this is a 19-day trade

- Yellow cell: The breakeven price point is $24.80 ($28.00 for covered call writing)

- Brown cell: The initial time-value return is 0.81%, 15.49% annualized (1.69%, 32.38% annualized for covered call writing)

- Purple cell: If shares are “put” to us at the breakeven price point of $24.80, it will represent a 12.92% discount from the price of UTI when the trade was entered

Discussion

Both covered call writing and selling cash-secured puts can be utilized with the same security in the same contract cycle. These UTI examples exploited calls for a bullish approach and puts for a conservative path.

Author: Alan Ellman