Using Bitcoin to Create a Low-Risk, High Initial Return Cash-Secured Put Trade – July 21, 2025

The most well-known form of cryptocurrency is Bitcoin. I am frequently asked about the use of crypto with our covered call and cash-secured put trades. In this article, a 1-week cash-secured put trade is analyzed, using Bitcoin, to construct a low-risk, high potential return trade. A real-life example with iShares Bitcoin Trust (Nasdaq: IBIT) is presented.

What is IBIT?

This is an exchange-traded fund (ETF). The shares are intended to constitute a simple means of making an investment similar to an investment in bitcoin rather than by acquiring, holding and trading bitcoin directly on a peer-to-peer or other basis or via a digital asset exchange. Since the implied volatility of this security is robust, there is flexibility that allows us to craft low-risk (not no-risk) trades that still offer significant initial time-value returns.

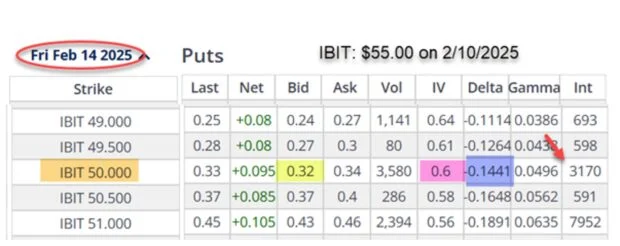

1-week cash-secured put option chain on 2/10/2025, expiring 2/14/2025

- With IBIT trading at $55.00, the $50.00 OTM put strike (brown cell) has a bid price of $0.32 (yellow cell)

- Note that the option liquidity is favorable with 3170 contracts of open interest (red arrow)

- The implied volatility is robust (60%) (pink cell)

- The Delta shows a probability of expiring in-the-money of 14.4% (blue cell), making the probability of being subject to exercise at approximately 85.6%, a low-risk trade

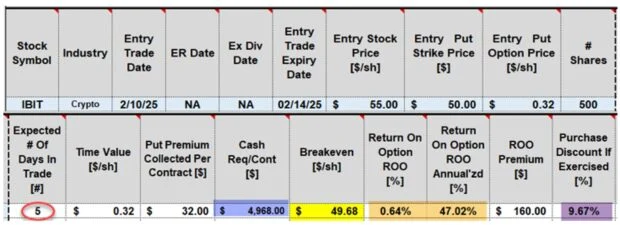

Initial trade calculations using the BCI Trade Management Calculator (TMC)

- The spreadsheet shows a 5-day trade (red circle)

- Selling 5 contracts generated $160.00 in option premium (white cell)

- Cash required to secure the each put contract: $4968.00 (blue cell)

- The breakeven price point is $49.68 (yellow cell)

- The initial 5-day time-value return is 0.64%, 47.02% annualized (brown cells)

- If the price of IBIT drops below the OTM $50.00 put strike, and no exit strategy intervention is executed, shares will be purchased at the breakeven price point of $49.68, which represents a 9.67% discount from the price when the trade was initiated (purple cell)

Discussion

Bitcoin can be implemented in our covered call writing and cash-secured put trades while still aligning with our goals of cash preservation and low-risk, significant initial returns criteria. We must bear in mind that these are low risk, not no risk trades and should always be prepared to act when our exit strategy arsenal opportunities present.

Author: Alan Ellman