Can We Generate Significant Returns with a Defensive 4-Day Cash-Secured Put Trade? – August 25, 2025

In bear and volatile markets, our cash-secured put trades (covered calls too) should be structured in a defensive manner. Greater protection to the downside typically means lower returns. That’s the tradeoff. We may opt for weekly trades which frequently result in higher annualized returns. What if we are in a holiday-shortened week, creating 4-day trades? Can we still generate significant premium returns with elite-performing underlying securities? In this article, a real-life example with Agnico Eagle Mines Limited (Nasdaq: AEM) will be examined to show that, yes, this is frequently possible. This trade (10 contracts) was taken directly from one of Alan’s portfolios.

AEM from our BCI Premium Stock Screen & Watch List

- AEM: $117.06

- #7 on IBD 50

- 1.20% dividend yield

- Ex-dividend date 2/28/2025

- Robust implied volatility (IV): 64.40%

- Industry segment rank: A (Mining)

- Next ER: 4/24/2025

- Bullish On Balance Volume (OBV)

- Analyst rating (MAR) a stellar 1.56

- Weekly options not available

- On our premium watch list for 4 weeks

- The $110.00 4/17/2025 deep OTM put strike has a bid price of $0.55

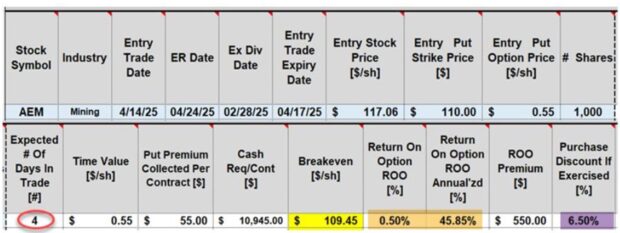

4-day initial calculations using the BCI Trade Management Calculator (TMC)

- The initial 4-day (Good Friday holiday) option return is significant (0.50%, 45.85% annualized- brown cells)

- If share value drops below the $110.00 strike price, and no exit strategy intervention is taken, shares are purchased at the breakeven strike price ($109.45 yellow cell), a 6.50% discount (purple cell) from share price when the trade was executed

Broker confirmation of AEM put sales including commissions

A credit of $293.35 was added to the cash account.

Final trade results

On Thursday 4/17/2025 (expiration Thursday), AEM closed well above the $110.00 put strike. The 0.50% 4-day trade, 45.85% annualized trade was realized.

Discussion

Using a well-thought-out screening process to generate a watchlist of elite-performing securities, will allow us to both take defensive postures with our trades while also allowing for significant returns. As always, we must be prepared to use our exit strategies if and when those opportunities arise.

Author: Alan Ellman