How To Negotiate Better Option Prices Using The “Show or Fill Rule” – August 4, 2025

Covered call writers & sellers of cash-secured puts generate cash flow by selling options, leveraging elite-performing stocks and ETFs. Options prices are published in option chains in the form of bid-ask spreads. We sell at the “bid” price and buy at the “ask” price. The range between the bid and ask is known as the bid-ask spread. The wider the spread, the more profit for the market-makers. This article will analyze how we can negotiate better option prices leveraging the SEC’s Show or Fill Rule.

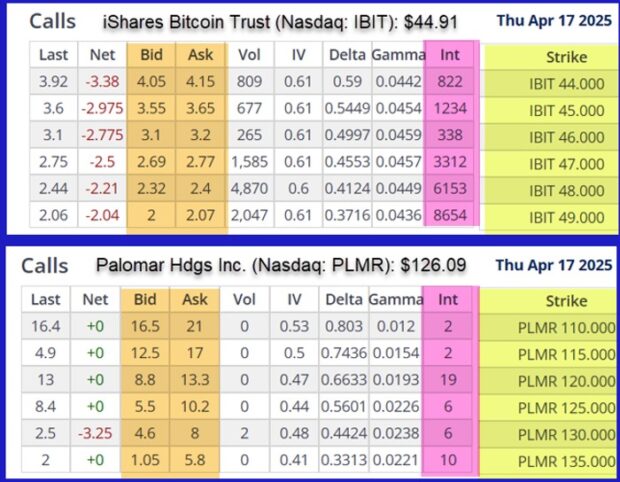

Examples of tight and wide bid-ask spreads (brown cells)

- Note the tight bid-ask spreads for IBIT (brown cells on top) and the substantial open interest (liquidity- pink cells on top)

- Note the wide bid-ask spreads for PLMR (brown cells on bottom) and the deficiency of open interest (liquidity- pink cells on bottom)

What is the Show or Fill Rule?

- Leveraging the Show or Fill Rule, also called the “Limit Order Display rule,” is an option trading strategy where a trader sets a limit order that must either be displayed on the market order book (option chain) or immediately executed (filled) by a market maker

- This action forces the market-maker to either fill the order immediately or publish the order, decreasing the bid-ask spread

- This can assist traders negotiate better prices by forcing market-makers to decide to execute smaller orders at the better price or decrease the published spread

- I view this SEC rule particularly useful to retail investors who are executing small numbers of option contracts

Real-Life Example with Veeva Systems Inc (Nasdaq: VEEV)

- Find the “mark” (midpoint of the spread): $6.40

- Drop down a bit in the limit order to slightly favor the market-maker: $6.35

- Enter a limit order, not a market order, at $6.35 (Day order, not good until cancelled)

- If the broker platform displays an All or None (AON) Box, do not check it

- Some brokerages negotiate for us, but using this methodology will ensure best price executions

- Use for spreads > $0.10

Broker Trading Platform: Entries for VEEV

- #1: Enter ticker & type of option

- #2: Enter action desired and the # of contracts

- #3: Enter limit order, price and day order

- #4: Enter desired expiration date and strike price

- The bid-ask spread is shown in the red oval

What if the $6.35 Order is Not Executed?

- The new published spread is $6.10 – $6.35

- Find the mark: $6.22

- Drop down to favor the market-maker: $6.20

- Enter a limit order at $6.20

- If that order is not executed, go with the published bid of $6.10

Discussion

- Leveraging the SEC’s Show or Fill Rule will put cash in our pockets

- It is effective, most of the time, when the principles in this discussion are followed

- The worst-case scenario is going with the published bid price which may meet our pre-stated initial time-value return goal range

Author: Alan Ellman