How to Set Up a Defensive Cash-Secured Put Trade in Challenging Market Conditions – August 11, 2025

Cash-Secured Put and covered call trades can be established as traditional, aggressive or defensive. In March 2025, there was market uncertainty regarding the imposition of multiple tariffs and their potential negative impact on our economy and the stock market.

During this time, I was creating only defensive positions in my option portfolios. In this article, I will share one such 4-week cash-secured trade I executed with DocuSign, Inc. (Nasdaq: DOCU).

Reasons for selecting DOCU from the BCI Premium Stock Report & Watch List

- DOCU: $88.15

- Selected from BCI database

- On our stock list for 1 week (welcome back)

- No dividend

- Modest implied volatility (IV): 33.2%

- Industry segment rank: A (Software)

- Next ER: 6/12/2025

- Bullish On Balance Volume (OBV)

- Analyst rating (MAR) 2.83 (above average)

- Weekly options available

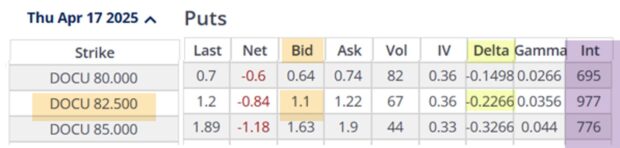

- $82.50 4/18/2025 deep OTM $82.50 put strike has a bid price of $1.10

DOCU option chain on 3/24/2025 (DOCU: $88.15)

Cash-Secured Put and covered call trades can be established as traditional, aggressive or defensive. In March 2025, there was market uncertainty regarding the imposition of multiple tariffs and their potential negative impact on our economy and the stock market.

During this time, I was creating only defensive positions in my option portfolios. In this article, I will share one such 4-week cash-secured trade I executed with DocuSign, Inc. (Nasdaq: DOCU).

Reasons for selecting DOCU from the BCI Premium Stock Report & Watch List

- DOCU: $88.15

- Selected from BCI database

- On our stock list for 1 week (welcome back)

- No dividend

- Modest implied volatility (IV): 33.2%

- Industry segment rank: A (Software)

- Next ER: 6/12/2025

- Bullish On Balance Volume (OBV)

- Analyst rating (MAR) 2.83 (above average)

- Weekly options available

- $82.50 4/18/2025 deep OTM $82.50 put strike has a bid price of $1.10

DOCU option chain on 3/24/2025 (DOCU: $88.15)

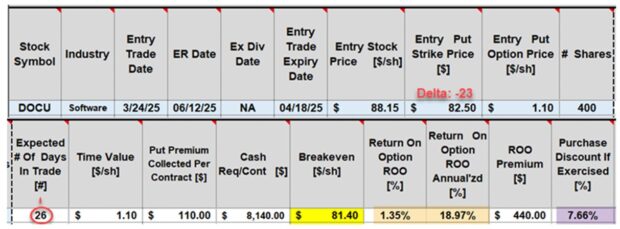

- The spreadsheet shows that, if taken through expiration, this is a 26-day trade (red circle)

- The breakeven price is $81.40 (yellow cell)

- The initial 26-day return is 1.35%, 18.97% annualized (brown cells)

- If share price declines below the $82.50 strike price and no exit strategy intervention is executed, shares will be “put” to us at the breakeven price of $81.40, a 7.66% discount (purple cell) from share price when the trade was initiated

Discussion

By implementing the low-risk option-selling strategy of selling cash-secured puts, we have generated significant initial returns and lowered our breakeven price from $88.15 to $81.40. The BCI 3% guidelines tells us to consider closing the trade if shares price dips below $80.00. These defensive trades are extremely low-risk but are not no-risk trades.

Author: Alan Ellman