Using the Zero-Dollar Collar to Protect Greatly Appreciated Shares – August 18, 2025

We can use put options as a hedge against share price decline of our long stock positions. This may be particularly useful after exponential price acceleration, and we want to protect our unrealized gains. This would represent an insurance policy that costs money. The debit for this protection can be partially or totally negated by simultaneously selling covered call options. The 3 components of this trade are collectively known as the collar strategy and when the net debit or credit approaches zero, the trade is known as a zero-dollar collar.

Components of a collar

- Own 100 shares of the underlying security (stock or exchange-traded fund) per contract

- Sell (usually) an out-of-the-money call option

- Buy (usually) an out-of-the-money put option

- The net premium can be a debit, credit or break even

What is a zero-dollar collar?

- This is a collar where the premium generated from the call option is equal to or nearly the same as the cost of the put premium resulting in a low-cost or no cost scenario on the option side

- If this can be accomplished, we can then benefit from continued, but limited, share appreciation at little or no cost, while enjoying protection to the downside

- This strategy can be particularly useful for those trading with securities that were purchased at significantly lower prices than current market value

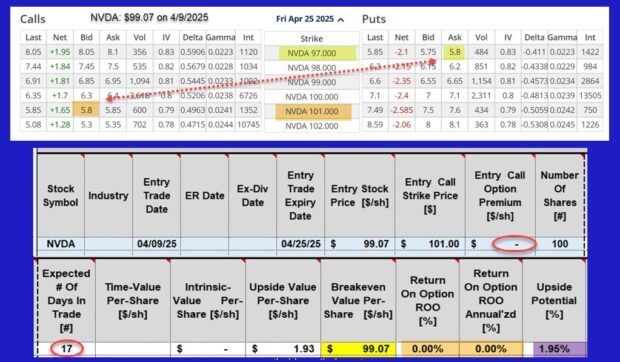

A real-life example with NVIDIA Corp. (Nasdaq: NVDA): Calculations with our Trade Management calculator (TMC)

- NVDA trading at $99.07

- Broken red arrow: option credit/debit = $0.00 (red oval), using the $101.00 call (brown cell) and the $97.00 put (yellow cell)

- Brown cells: No option credit or debit

- Purple cell: 1.95% upside potential if share price moves from $99.07 to the $101.00 call strike in this 17-day trade

Have our 3 goals been accomplished?

Provide downside protection against a substantial loss in share value

Yes. We are protected against any share depreciation below the $97.00 put strike. We are susceptible to share decline from $99.07 down to the $97.00 strike but no more than that.

Provide an opportunity of limited share appreciation from current market value up to the call strike price

Yes. We retain the potential for share appreciation from $99.07 up to the $101.00 call strike. This would represent a 1.95% 17-day return or an 41.86% annualized return.

Result in a low or no-cost option collar or a zero-dollar collar

Yes. We have an option credit on the call side of $5.80 and also a put debit of $5.80 resulting in a zero-dollar collar.

Discussion

For those who have a portfolio consisting of low-cost basis securities the zero-dollar collar may be a useful tool. It is a no-cost way of generating protection against significant loss in share value while at the same time still offering an opportunity for share appreciation.

Author: Alan Ellman