A Defensive 4-Day Cash-Secured Put Trade Start-to-Finish – September 29, 2025

Cash-secured put trades can be crafted conservatively by using deep out-of-the-money (OTM) strikes. On 5/27/2025, I executed such a 4-day trade with NetEase Inc. (Nasdaq: NTES), a stock on our premium member watch list at the time. This article will analyze the reasons for trade entries, strike selection and final trade results.

Why I selected NTES on 5/27/2025

- Located in the software industry segment, ranked “A”

- Had an excellent mean analyst rating (MAR) of 1.41

- No earnings report or ex-dividend date concerns

- All-bullish chart technical indicators

- An elite-performer from a fundamental perspective

- Weekly options available

- Robust implied volatility (33.8%) allowing for significant returns, even in a holiday-shortened week

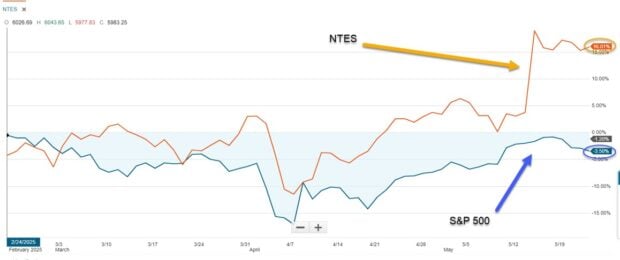

1-Month Price Chart of NTES vs. the S&P 500

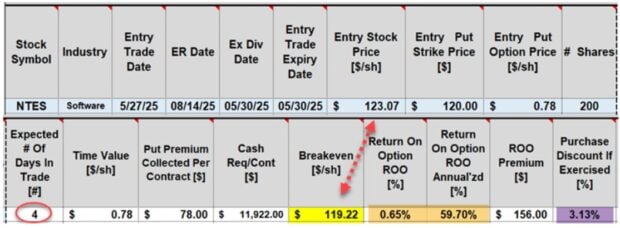

Initial Cash-Secured Put Trade Calculations Using the BCI Trade Management Calculator (TMC)

- The initial time-value return is 0.65%, 59.70% annualized (brown cells)

- The BE price point is $119.22 (yellow cell)

- If exercised, NTES is purchased at a 3.13% discount (purple cell)

Broker Trade Confirmation

Final Trade Status as of 4 PM ET on 5/30/2025

- NTES trading at $121.76

- $1.31 below the price at trade execution ($123.07)

- $1.21 above OTM put strike ($120.00)- option expires OTM and worthless

- Realized final 4-day return of 0.65%, 59.70% annualized

- No need for exit strategy intervention

Discussion

Significant returns can be generated with 4-day cash-secured put trade. Option trades can be crafted to align with all market environments and personal risk tolerance. In the case of NTES, a significant 4-day return was realized despite the share price decline of $1.31/share.

Author: Alan Ellman