Rolling-Up a Weekly Defensive Cash-Secured Put Trade – September 15, 2025

Sep 13, 2025 | Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Put-selling, Stock Option Strategies

When a cash-secured put is sold, we agree to buy the shares at the strike price by the expiration date. We, the option-sellers, determine those 2 parameters. In our BCI methodology, we favor out-of-the-money (OTM) put strikes. In bear and volatile markets, deeper OTM strikes will offer greater protection to the downside. In this article, a real-life example with Palantir Technologies Inc. (Nasdaq: PLTR) will be analyzed to demonstrate trade entry and management as share price accelerated and the option was rolled-up for additional cash premium returns.

Real-life weekly example with PLTR (from1 of Alan’s portfolios)

- 4/21/2025: PLTR trading at $90.49

- 4/21/2025: STO 4 x 4/25/2025 deep OTM $79.00 put strike at $0.52 ($208.00)

- 4/23/2025: BTC 4 x 4/25/2025 $79.00 put at $0.02 (as share price rose exponentially)

- 4/23/2025: STO 4 x 4/25/2025 $98.00 puts at $0.33 for an additional net credit of $124.00 ($31.00 x 4)

- 4/25/2025: PLTR closed at $112.78 causing the $98.00 put to expire worthless, the best-case scenario

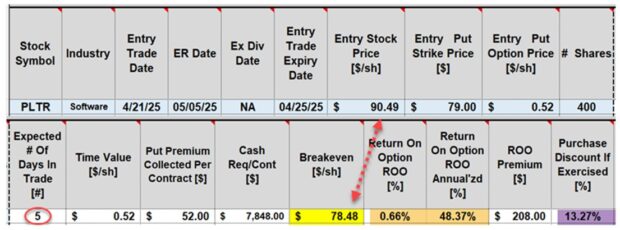

PLTR initial trade calculations with our Trade Management Calculator (TMC)

- Red circle: 5-day trade

- Yellow cell: Breakeven price is $78.48 (from $90.49)

- Brown cells: Initial 5-day return is 0.66%, 48.37% annualized

- If share price dips below the $79.00 strike and no exit strategy intervention is executed, the share will be put to us at a discount of 13.27%- purple cell ($78.48)

Broker statement confirmation of rolling-up trade

Final realized trade results

- Total premiums: $340.00 ($208.00 + $132.00, less miniscule trade commissions)

- Cost basis: $38,868.00 (cash required to secure 4 puts)

- 5-day realized, unexercised return = 0.88% = 64.24% annualized

Discussion

Significant returns can be generated even with a 5-day defensive cash-secured put trade. Option trades can be crafted to align with all market environments. In the case of PLTR, returns were still robust due to the high implied volatility and the rolling-up opportunity.

Author: Alan Ellman