Using Both ITM & OTM Covered Calls to Align with Current Market Conditions – September 22, 2025

When establishing our covered call portfolios (cash-secured puts, too), our strike selection is influenced by current market conditions. In normal-to-bull markets, we favor out-of-the-money (OTM) strikes which allow for a 2-income stream potential (premium + share appreciation from current market value up to the OTM call strike). In bear- volatile markets, we may promote in-the-money (ITM) strikes which provide greater protection to the downside.

In this article, I will demonstrate how both ITM & OTM strikes can be used in a bearish-mixed market environment. I will use Shopify Inc. (Nasdaq: SHOP), real-life examples taken from one of my option portfolios on 5/20/2025. Of the 4 call contracts I sold that day, 3 were defensive (ITM) and 1 was aggressive (OTM).

The BCI premium stock report on 5/209/2025

- All fundamental, technical and common-sense screens were passed

- Note the ticker is in bold, indicating that all technical parameters were bullish

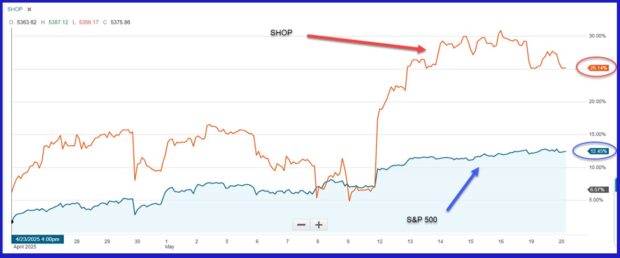

SHOP 1- Month Price Chart vs. S&P 500

- In the past 1-month, SHOP was up in price by 25.14% (red arrow and oval)

- In the past 1-mont, the S&P 500 was up by 12.45% (blue arrow and circle)

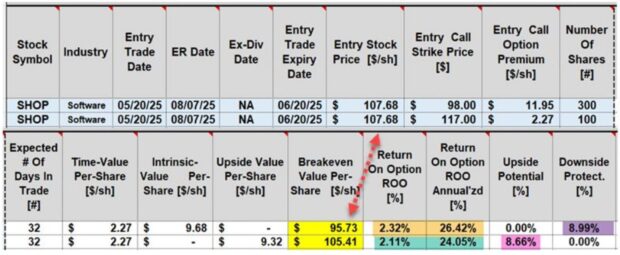

Initial Covered Call Trade Calculations with our BCI Trade Management Calculator

- The ITM $98.00 strike (3 contracts) has a 32-day initial time-value return of 2.32%, 26.42% annualized (brown cells)

- The ITM $98.00 strike has a downside protection of that 2.32% return of 8.99% (purple cell) and a breakeven price point at $95.73 (top yellow cell)

- The OTM $117.00 strike (1 contract) has a 32-day initial time-value return of 2.11%, 24.05% annualized (green cells)

- The OTM $117.00 strike has an upside potential of 8.66% (pink cell) and a breakeven price point at $105.41 (bottom yellow cell)

Discussion

When crafting our option portfolios, strike selection should reflect both our personal risk-tolerance as well as an analysis of current market conditions. In this article, 3 of the 4 SHOP covered call contracts sold reflected a bearish sentiment and 1 a more aggressive bias. I refer to these as laddering strikes and is another form of diversification.

Author: Alan Ellman