What is Quantifying Risk: Part I- Using Delta – September 2, 2025

When analyzing the risk of our covered call writing or cash-secured put trades, we typically are referring to the exposure of losing capital. However, there is also the risk of exercise, which we may want to avoid. In the case of calls, it is the potential sales of our shares; and in the case of puts, it’s the possibility of having to purchase shares. In this article, Delta will be highlighted as one of the ways to measure or quantify these liabilities.

What is Delta?

Delta has multiple definitions. The one that applies to estimating the risk of our trades is as follows: The approximate probability of the option expiring in-the-money or with intrinsic-value.

Covered call risk example

We may not want our shares sold. We would then select an out-of-the-money strike based on the amount of risk we are willing to incur. This will vary from investor-to-investor. We also want to be sure that the premium returns align with our pre-stated initial time-value return goal range. Since mitigating risk comes at a cost, we would anticipate lower returns than traditional option selling.

Cash-secured put risk example

We may not want to purchase the underlying shares. We would then select an out-of-the-money strike based on the amount of risk we are willing to incur. This will also vary from investor-to-investor. We also want to be sure that the premium returns align with our pre-stated initial time-value return goal range. Since mitigating risk comes at a cost, we would anticipate lower returns than traditional option selling.

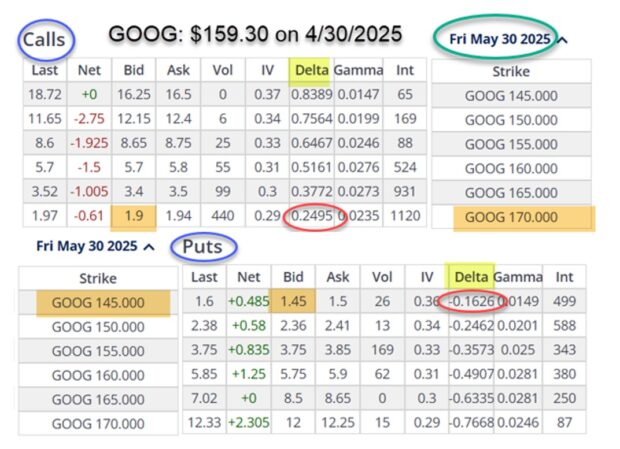

Real-life example with Alphabet, Inc. (Nasdaq: GOOG): Option-Chain on 4/30/2025

- The $170.00 OTM covered call strike shows a Delta of 0.2495 or 25%. This is the risk of expiring ITM and subject to exercise

- If we wanted to expose ourselves to more or less risk, we would select strikes accordingly

- The bid price of this $170.00 call is $1.90/share

- The $145.00 cash-secured put strike displays a Delta of -0.1626 or 16%. This is the risk of expiring ITM and subject to exercise

- If we wanted to expose ourselves to more or less risk, we would select strikes accordingly

- The bid price of this $145.00 put is $1.45

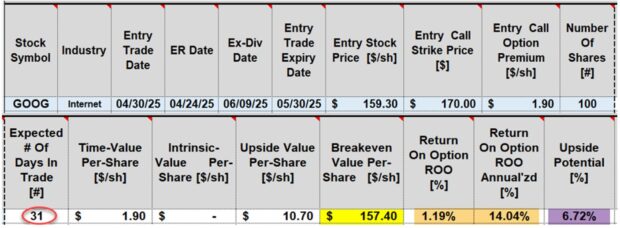

GOOG: Covered call calculations: The BCI Trade Management Calculator (TMC)

- Red circle: This is a 31-day trade, if taken through contract expiration

- Yellow cell: The breakeven price is $157.40

- Brown cells: The 31-day return is 1.19%, 14.04% annualized

- The upside potential is 6.72%, for a max 31-day potential return of 7.91%

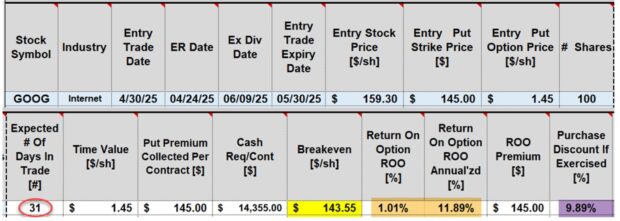

GOOG: Cash-secured put calculations: The BCI Trade Management Calculator (TMC)

- Red circle: This is a 31-day trade, if taken through contract expiration

- Yellow cell: The breakeven price is $143.55

- Brown cells: The 31-day return is 1.01%, 11.89% annualized

- The purchase discount if exercised is 9.89%

Discussion

The approximate amount of risk we are subject to in our option-selling trades can be quantified using Delta. The greater the risk that aligns with our personal risk tolerance, the higher will be our initial time-value returns and vice-versa. Despite taking defensive postures to our trades, the returns can still be significant.

Author: Alan Ellman