Comparing Weekly, Monthly and Longer-Term Covered Call Expirations Using the Same Strike Price – October 6, 2025

A common misconception made by many retail investors is that they make more money selling longer-dated options because the dollar amount is so much greater than shorter-dated choices. This article will provide an analysis to refute this fallacy. A real-life example with NVIDIA Corp. (Nasdaq: NVDA) will be studied but any stock or ETF can be used with the same results.

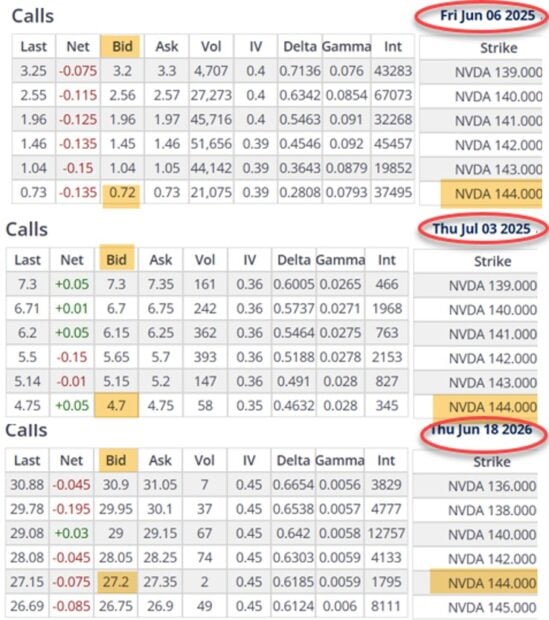

NVDA analysis on June 4, 2025

- NVDA trading at $141.39

- The 6/6/2025 $144.00 call has a bid price of $0.72

- The 7/3/2025 $144.00 call has a bid price of $4.70

- The 6/18/2026 $144.00 call has a bid price of $27.20

Can you see how enticing that 6/18/2026 premium can be for retail investors? Me too.

NVDA 3-option-chains on 6/4/2025

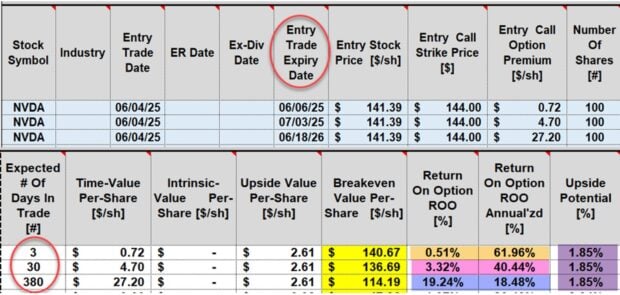

NVDA initial calculations of the 3 expiration dates using the BCI Trade Management Calculator (TMC)

- The shortest-term 6/6/2025 expiration shows an initial 3-day return of 0.51%, 61.96% annualized

- The 30-day initial return is 3.32%, 40.44% annualized

- The longest-term, 380-day LEAPS initial return is 19.24%, 18.48% annualized

We must avoid the “shiny object” dollar amount return from long-dated options and focus on the annualized returns.

Discussion

Shorter-dated options will provide the opportunities for the greatest annualized returns. Other advantages include allowing us to re-evaluate our bullish assumptions on the underlying securities more frequently and assisting us in avoiding earnings reports and ex-dividend dates.

Author: Alan Ellman