How to Earn More than a Maximum Return with a Defensive Covered Call Trade – November 17, 2025

When crafting our covered call trades to offer greater protection to the downside, we favor in-the-money (ITM) call strikes. These provide lower breakeven price points because ITM strikes consist of both time-value and intrinsic-value. At-the-money (ATM) and out-of-the-money (OTM) strikes are all time-value.

When share price rises substantially during the contract, our maximum returns are well protected. But can we generate even more profit by executing one of BCI’s exit strategies? Of course, the answer is yes, or I wouldn’t be writing this article. A real-life example will be analyzed using Celestica Inc. (NYSE: CLS) and Datadog, Inc. (Nasdaq: DDOG) during a 5-day contract. In the BCI methodology, this exit strategy is known as the mid-contract unwind (MCU) exit strategy.

Overview of CLS (defensive covered call trade) and DDOG (traditional covered call trade) trades

- 6/23/2025: Buy 200 x CLS at $133.95

- 6/23/2025: STO 2 x 6/27/2025 CLS $128.00 calls at $7.15

- 6/25/2025: CLS trading at $149.24

- 6/25/2025: BTC 2 x 6/27/2025 CLS $128.00 calls at $21.80

- 6/25/2025: Sell 200 x CLS at $149.24

- 6/25/2025: Buy 200 x DDOG at $131.70

- 6/25/2025: STO 2 x $133.00 DDOG calls at $0.74

- 6/27/2025: DDOG trading at $132.08 at expiration

- 6/27/2025: The DDOG call options expire worthless

- The unrealized share profit is $0.38/share

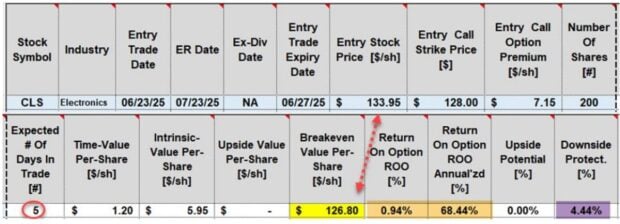

CLS initial trade calculations with the BCI Trade Management Calculator (TMC)

- Breakeven price lowered to $126.80 (yellow cell)

- Initial time-value returns are 0.94%, 68.44% annualized (brown cells)

- If we allow exercise, shares are sold at the $128.00 strike price, a discount of 4.44% (purple cell)

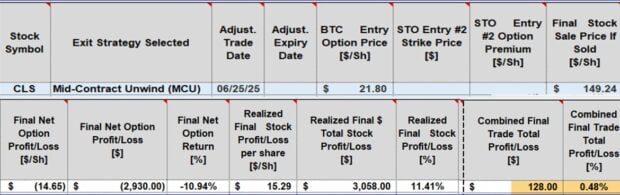

CLS final trade calculations with the BCI Trade Management Calculator (TMC)

- After buying back the option at $21.80 and selling the shares (at $149.24), there is a loss on the option side, but a significant gain on the stock side

- The net gain per contract is$128.00 or 0.48% (brown cells)

DDOG initial trade calculations with the BCI Trade Management Calculator (TMC)

- This 3-day trade, resulted in an initial return of 0.56%, 68.36% annualized (brown cells)

- It also left the potential for an additional return 0.99% if share price moved to the OTM $133.00 call strike at expiration

What Happened on Expiration Friday (6/27/2025)?

- DDOG closed at $132.08 (purchased at $131.70)

- The $133.00 call expired OTM, and shares were retained

- Combined realized 5-day option return (both trades): 1.04%, 75.92% annualized

- There is an additional unrealized 3-day share profit for DDOG of 0.29%

- I will decide on Monday if I will sell the shares or write another covered call

Discussion

- Significant returns can be generated with 5-day defensive covered call trades

- Option trades can be crafted to align with all market environments and personal risk tolerance

- In the case of CLS, closing the trade and executing another covered call was a reasonable path

- In this example, the mid-contract unwind (MCU) exit strategy was executed, resulting in greater than an initial maximum return

Author: Alan Ellman