Covered Call Writing Insurance Policies We Pay for and Those that are Free – May 12, 2025

Covered call writing trades can be crafted to be aggressive or defensive. Cautionary approaches include writing in-the-money (ITM) call strikes and adding protective puts to the covered call trades (converting the covered call trade to a collar trade). The former is free and paid for by the option buyer in the form of intrinsic-value premium. The latter is paid for by the option seller (that’s us) and will reduce our overall returns. In this article, a real-life example with NVDIA Corp. (Nasdaq: NVDA) will be analyzed using both approaches.

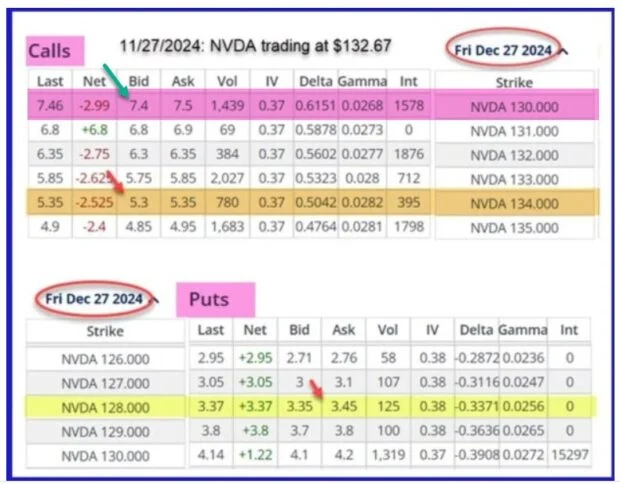

NVDA call/put option chain on 11/27/2024 for the 12/27/2024 contract expiration

Free insurance: The ITM call strike

ITM call strikes consist of both time-value and intrinsic-value (the amount the strike is lower than current market value). This results in a lower breakeven price than at-the-money or out-of-the-money call strikes, or additional insurance to the downside. This is paid for by the option buyer (not us) in the form of intrinsic-value, With NVDA trading at $132.67, the ITM $130.00 strike shows a bid price of $7.40 (pink row, green arrow).

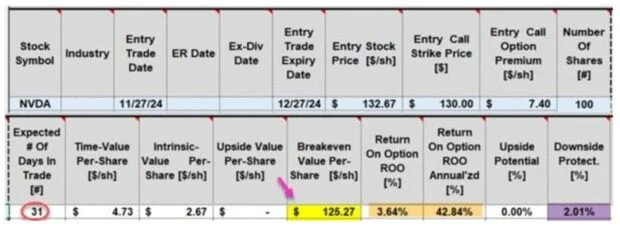

Free insurance calculations

- If taken through expiration, this is a 31-day trade (red circle)

- The initial time-value return is 3.64%, 42.84% annualized (brown cells)

- If exercised at the breakeven (BE) price of $125.27-yellow cell), the NVDA is purchased at a 2.01% discount (purple cell)

- This additional protection to the downside is paid for by the option buyers and free to us, the option sellers

Insurance we pay for: The collar trade

There are 3 legs to this defensive approach to covered call writing:

- Long stock (NVDA: $132.67)

- Short call (sets a ceiling on the trade- maximum gain- $134.00 call at $5.30): Brown row, red arrow

- Long put (sets a floor on the trade- maximum loss- $128.00 put at $3.45): Yellow row, red arrow

- The trade is structured to start with a new option credit ($5.30 – $3.45 = $1.85)

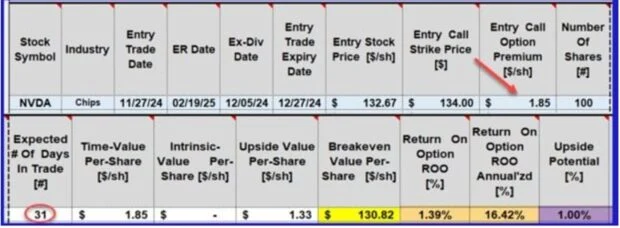

Insurance we pay for: Collar calculations with the BCI Trade Management Calculator (TMC)

- The net option credit ($1.85) is entered as the option premium

- The BE is higher than the free insurance at $130.82

- The initial time-value return is lower (1.39%, 16.42% annualized- brown cells)

- We have a defined maximum loss at the $128.00 put strike

- There is an additional upside potential of 1.00% (purple cell) if share price rises to or above the $134.00 call strike

Discussion

- The collar strategy adds a protective put to our covered call trades

- Protects us against overwhelming share price decline

- Time-value returns will be lower in exchange for the added protection

- Our collar trades can be managed by the BCI Trade Management Calculator (TMC)

- We do so, by deducting the put premium debit from the call premium credit

- We can establish both initial and final calculations using this spreadsheet

Author: Alan Ellman