A Real-Life Monthly Covered Call Trade with AVGO – June 2, 2025

Each week, BCI provides our premium members with a sample covered call writing or cash-secured put trade taken from one of Alan’s portfolios or from that of a member. These trades are all selected from the BCI premium member reports. In this article, a real-life trade with Broadcom Inc. (Nasdaq: AVGO) will be analyzed regarding initial setup and calculations and final trade results. This is an example of a successful trade. Most are, some are not.

Reasons for selecting AVGO: Information taken from the BCI Stock Screen and Watch List

-

- AVGO: $170.47

- On our stock list for 2 weeks

- #6 on IBD Big-Cap 20

- High implied volatility (IV): 39.8%

- Industry segment rank: B (Chips)

- Mean analyst rating of 1.41 (excellent)

- On balance volume: Bullish

- Next ER on 12/5/2024

- Dividend yield: 1.20%

- Ex-dividend date: 9/19/2024

- $175.00 monthly (10/18/24) OTM call strike has a bid price of $5.05

- Note: OTM call strikes offer time value + upside potential (2 income streams)

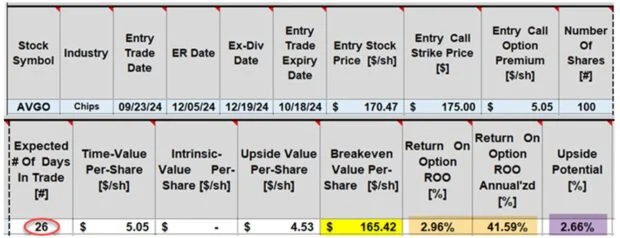

Initial trade calculations using the BCI Trade Management Calculator (TMC)

Evaluating initial results

Out-of-the-money strikes can generate significant initial time-value returns (2.96%, 41.59% annualized for the 26-days-brown cells). There is also significant upside (additional) potential of 2.66% (purple cell), if the share value moves higher. Since AVGO has a high implied volatility, premium returns are high, and risk is also greater than lower IV stocks. It’s important to be vigilant regarding exit strategy preparation, including our 20%/10% guidelines. If stock price moves below the breakeven price point ($165.42- yellow cell), we start to lose money if exit strategy implementation is not initiated. The 20% buy-to-close/ good until cancelled (BTC/GTC) guideline limit order is set at $1.01 (20% of $5.05).

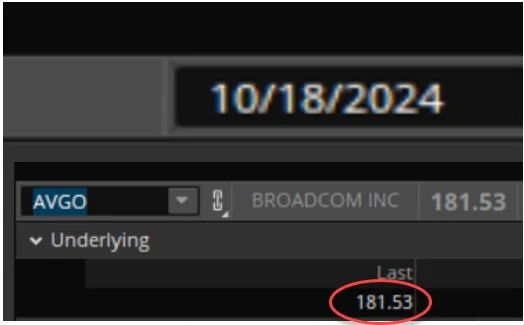

AVGO closing price on expiration Friday (10/18/2024)

AVGO closed well above the $175.00 strike due to a $5.00 increase in share price on expiration Friday. I allowed exercise and share were sold at $175.00. The final realized 26-day return was 5.62%, 78.9% annualized. A decision is made over the weekend as how to best use the cash generated from the sale of AVGO when the market opens on Monday. These decisions are based on the most recent BCI reports of eligible option candidates.

Discussion

This AVGO trade is an example of a winning trade with a maximum return. Other winning trades may not achieve max returns, and some will be losing trades. Mastering our exit strategy skillset is essential although none were needed for this particular trade.

Author: Alan Ellman