-

Calculating Multiple Call & Put Trades with the Same Stock in 2 Expiration Cycles – October 13, 2025

Calculating our covered call writing and cash-secured put trades can range anywhere from really simple to way too complicated. In this article, an example of the latter will be...

Read More -

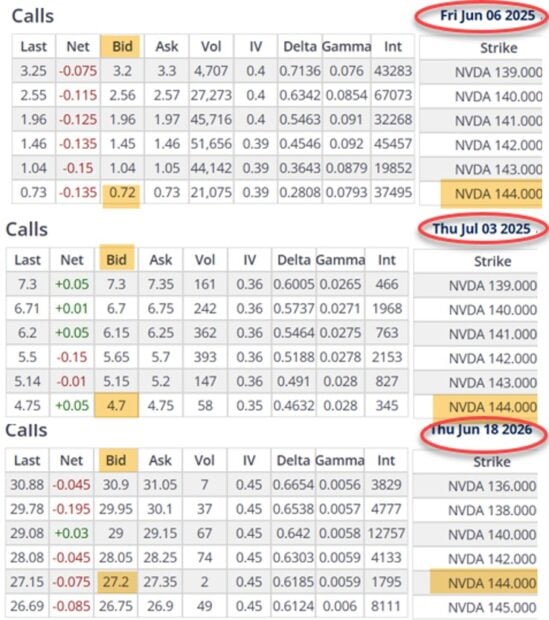

Comparing Weekly, Monthly and Longer-Term Covered Call Expirations Using the Same Strike Price – October 6, 2025

A common misconception made by many retail investors is that they make more money selling longer-dated options because the dollar amount is so much greater than shorter-dated choices. This...

Read More -

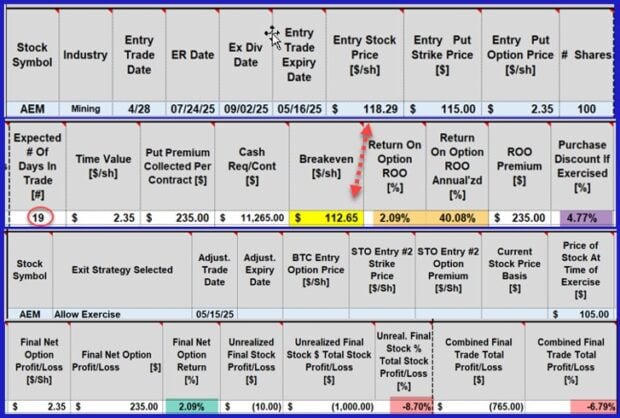

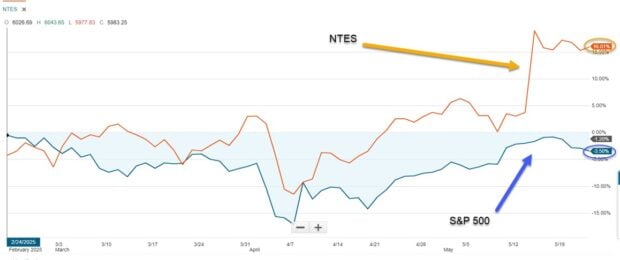

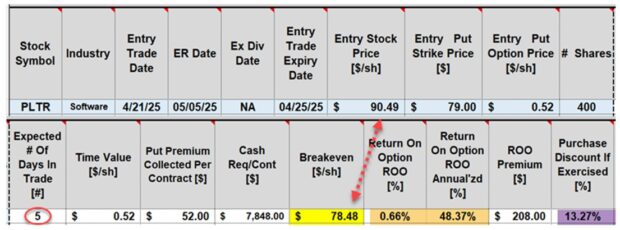

A Defensive 4-Day Cash-Secured Put Trade Start-to-Finish – September 29, 2025

Cash-secured put trades can be crafted conservatively by using deep out-of-the-money (OTM) strikes. On 5/27/2025, I executed such a 4-day trade with NetEase Inc. (Nasdaq: NTES), a stock on our premium...

Read More -

Using Both ITM & OTM Covered Calls to Align with Current Market Conditions – September 22, 2025

When establishing our covered call portfolios (cash-secured puts, too), our strike selection is influenced by current market conditions. In normal-to-bull markets, we favor out-of-the-money (OTM) strikes which allow for...

Read More -

Rolling-Up a Weekly Defensive Cash-Secured Put Trade – September 15, 2025

Sep 13, 2025 | Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Put-selling, Stock Option Strategies When a cash-secured put is sold, we agree to buy the shares at the strike price by the expiration date....

Read More -

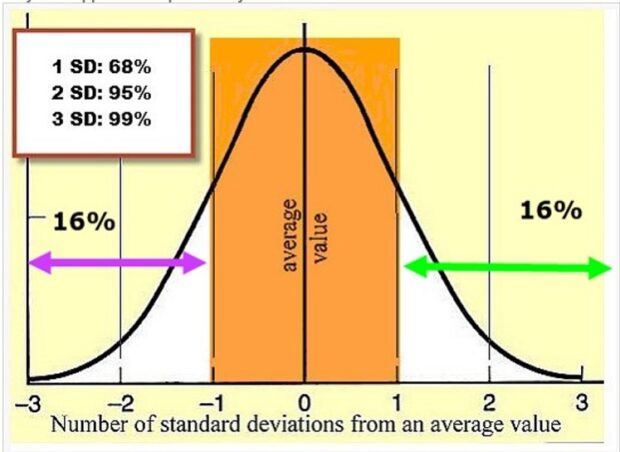

What is Quantifying Risk: Part II- Using Implied Volatility (IV) – September 8, 2025

In a recent article titled What is Quantifying Risk: Part I- Using Delta, one methodology of measuring the risk of our covered call writing and cash-secured put trades was analyzed. In...

Read More -

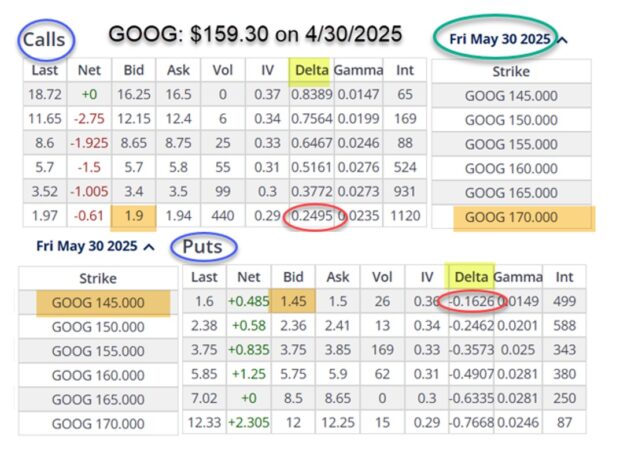

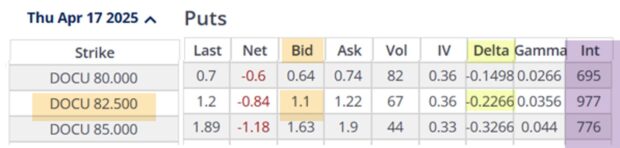

What is Quantifying Risk: Part I- Using Delta – September 2, 2025

When analyzing the risk of our covered call writing or cash-secured put trades, we typically are referring to the exposure of losing capital. However, there is also the risk of exercise,...

Read More -

Using the Zero-Dollar Collar to Protect Greatly Appreciated Shares – August 18, 2025

We can use put options as a hedge against share price decline of our long stock positions. This may be particularly useful after exponential price acceleration, and we want...

Read More -

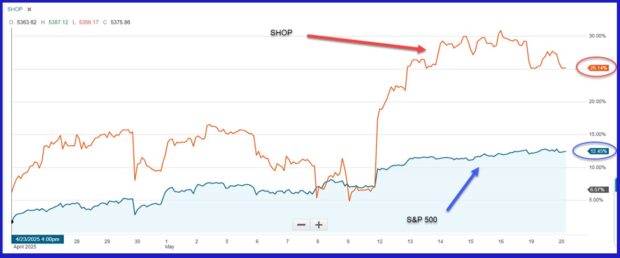

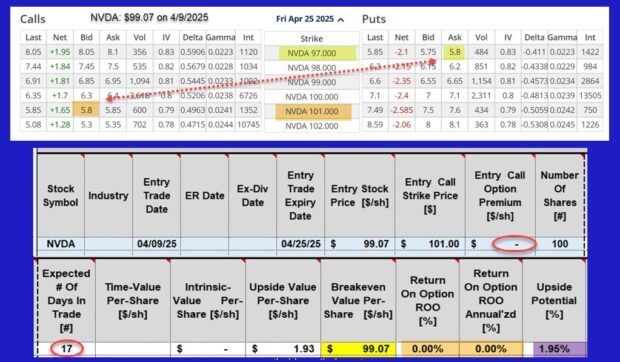

How to Set Up a Defensive Cash-Secured Put Trade in Challenging Market Conditions – August 11, 2025

Cash-Secured Put and covered call trades can be established as traditional, aggressive or defensive. In March 2025, there was market uncertainty regarding the imposition of multiple tariffs and their...

Read More -

How To Negotiate Better Option Prices Using The “Show or Fill Rule” – August 4, 2025

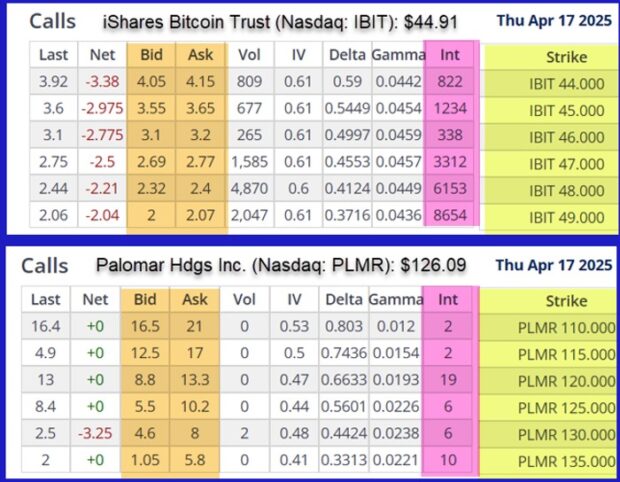

Covered call writers & sellers of cash-secured puts generate cash flow by selling options, leveraging elite-performing stocks and ETFs. Options prices are published in option chains in the form of bid-ask...

Read More