-

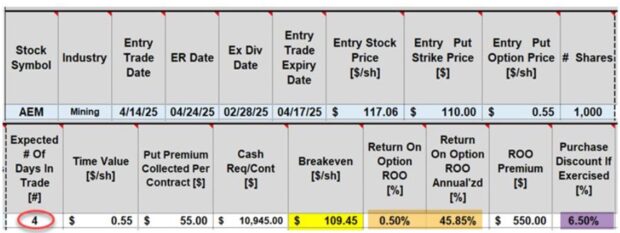

Can We Generate Significant Returns with a Defensive 4-Day Cash-Secured Put Trade? – August 25, 2025

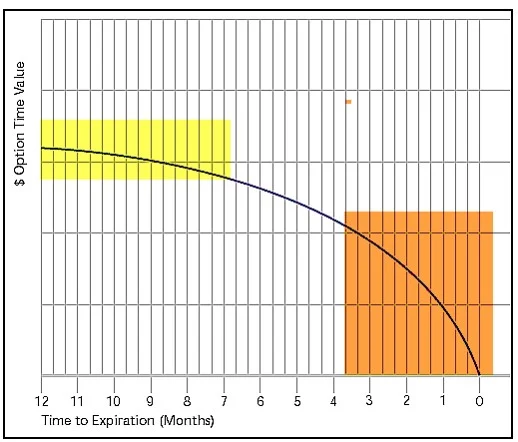

In bear and volatile markets, our cash-secured put trades (covered calls too) should be structured in a defensive manner. Greater protection to the downside typically means lower returns. That’s the tradeoff....

Read More -

Using the Zero-Dollar Collar to Protect Greatly Appreciated Shares – August 18, 2025

We can use put options as a hedge against share price decline of our long stock positions. This may be particularly useful after exponential price acceleration, and we want...

Read More -

How to Set Up a Defensive Cash-Secured Put Trade in Challenging Market Conditions – August 11, 2025

Cash-Secured Put and covered call trades can be established as traditional, aggressive or defensive. In March 2025, there was market uncertainty regarding the imposition of multiple tariffs and their...

Read More -

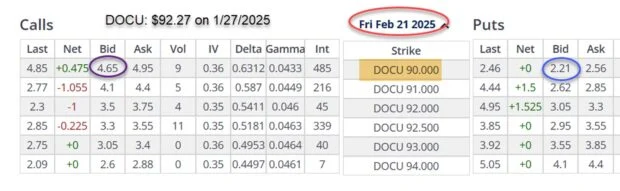

How To Negotiate Better Option Prices Using The “Show or Fill Rule” – August 4, 2025

Covered call writers & sellers of cash-secured puts generate cash flow by selling options, leveraging elite-performing stocks and ETFs. Options prices are published in option chains in the form of bid-ask...

Read More -

Selling Calls & Puts with the Same Stock in Mixed Market Conditions – July 28, 2025

Covered call writing and selling cash-secured puts trades can be structured to be more aggressive (out-of-the-money-OTM) covered calls and slightly OTM cash-secured puts or to lean defensive (in-the-money- ITM) covered calls and...

Read More -

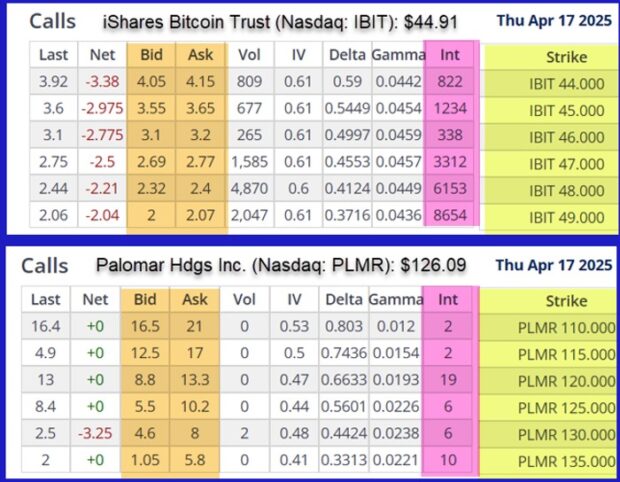

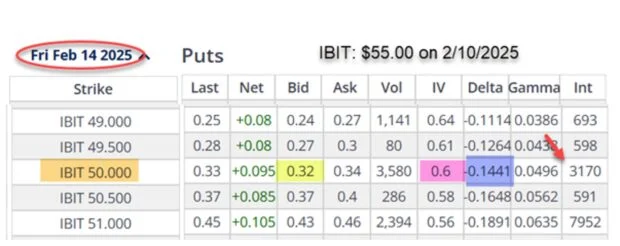

Using Bitcoin to Create a Low-Risk, High Initial Return Cash-Secured Put Trade – July 21, 2025

The most well-known form of cryptocurrency is Bitcoin. I am frequently asked about the use of crypto with our covered call and cash-secured put trades. In this article, a...

Read More -

Option Greeks as They Apply to Covered Call Writing – July 14, 2025

The option Greeks are financial metrics that are used by traders to evaluate the risk of our option contracts as well as how option price changes as it related to the...

Read More -

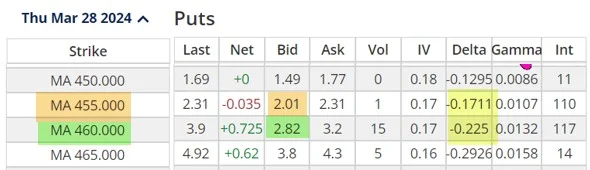

ITM Calls & OTM Puts: Similar Returns & Breakeven Price Points – July 7, 2025

When seeking a defensive posture to our covered call writing and cash-secured put trades, we use in-the-money (ITM) calls and deep out-of-the-money (OTM) puts. We must always determine our initial time-value...

Read More -

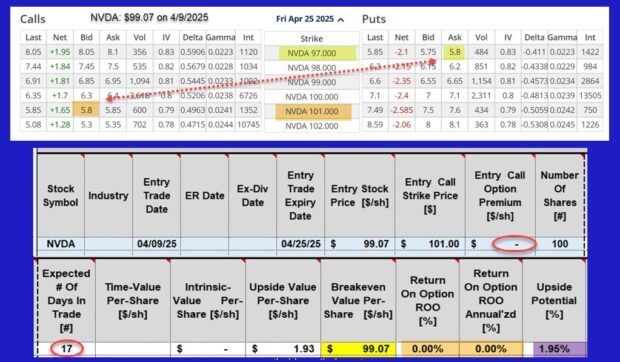

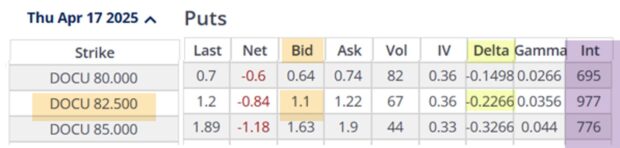

Explaining Delta and How to Use it to Craft Our Option Trades – June 30, 2025

Delta is one of the option Greeks. These are mathematical factors that estimate the risk of stock options. We can take advantage of Delta stats when establishing our covered call and...

Read More -

In 54-Days, My Stock Was Up $0.71/Share, but I Made $7.66/Share with Options – June 23, 2025

Selling covered calls and cash-secured puts lower our cost-basis and places us in a position to significantly beat the market. Mastering stock selection, option selection and position management are essential in...

Read More