-

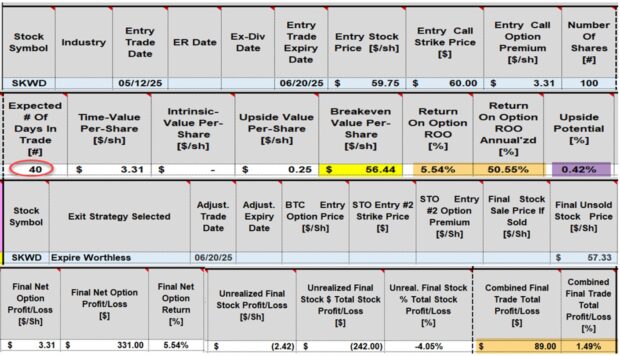

Calculating Realized & Unrealized Returns for an Expiring Worthless Covered Call Trade – December 1, 2025

We enter a covered call trade and share price declines, but not enough to trigger our 20%/10% BTC/ GTC limit orders (exit strategy buyback price points). The option expires worthless. There...

Read More -

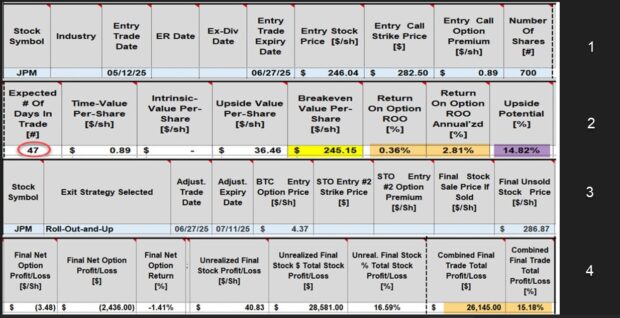

How to Calculate and Archive Results for a Rolling-Out-And-Up Covered Call Trade – November 24, 2025

When a covered call trade is expiring in-the-money (ITM), we may have an opportunity to retain the underlying shares by rolling-out or rolling-out-and-up. The latter is a more aggressive form...

Read More -

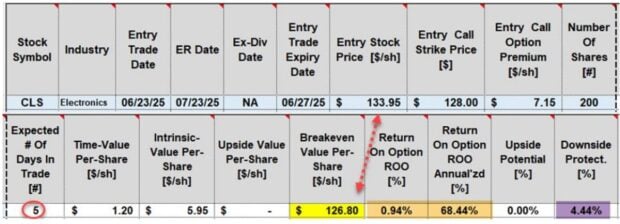

How to Earn More than a Maximum Return with a Defensive Covered Call Trade – November 17, 2025

When crafting our covered call trades to offer greater protection to the downside, we favor in-the-money (ITM) call strikes. These provide lower breakeven price points because ITM strikes consist...

Read More -

Strike Selection After Rolling-Out Our Portfolio Overwriting Trades – November 10, 2025

Portfolio overwriting is a covered call writing-like trading strategy. There are 2 distinctly defined goals: generating cash flow + retention underlying shares. Since deep out-of-the-money (OTM) strikes are used to...

Read More -

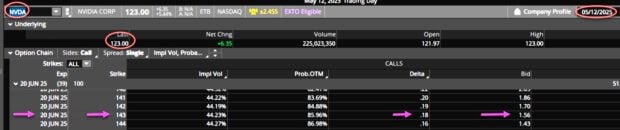

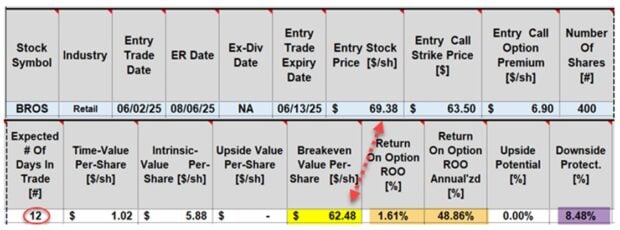

Beware of the Shiny Object When Establishing Covered Call Trades

One of the more common oversights made by retail investors is their focus on premium dollar amounts rather than annualized returns. I consider this “dollar distraction” the shiny object that prevents...

Read More -

Achieving Our Goal When Selling a Defensive Covered Call – October 27, 2025

When we structure our covered call trades in a defensive manner, we have 2 main goals in mind. We seek greater protection to the downside than traditional put trades...

Read More -

Pros & Cons of Leveraged ETFs When Selling Stock Options – October 20, 2025

Retail investors may become enticed to use leveraged exchange-traded funds (ETFs) when writing covered calls or selling cash-secured puts. The reason is that the option returns are generally so much greater...

Read More -

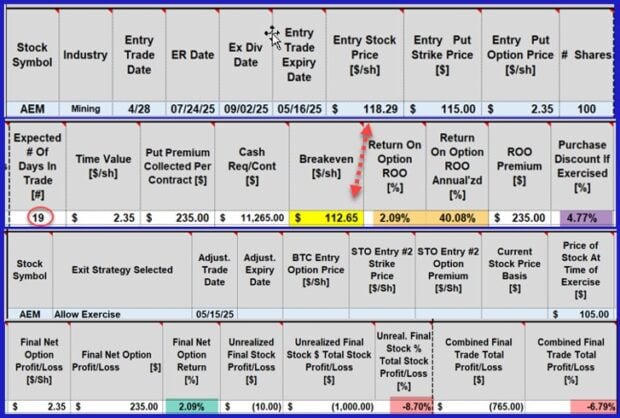

Calculating Multiple Call & Put Trades with the Same Stock in 2 Expiration Cycles – October 13, 2025

Calculating our covered call writing and cash-secured put trades can range anywhere from really simple to way too complicated. In this article, an example of the latter will be...

Read More -

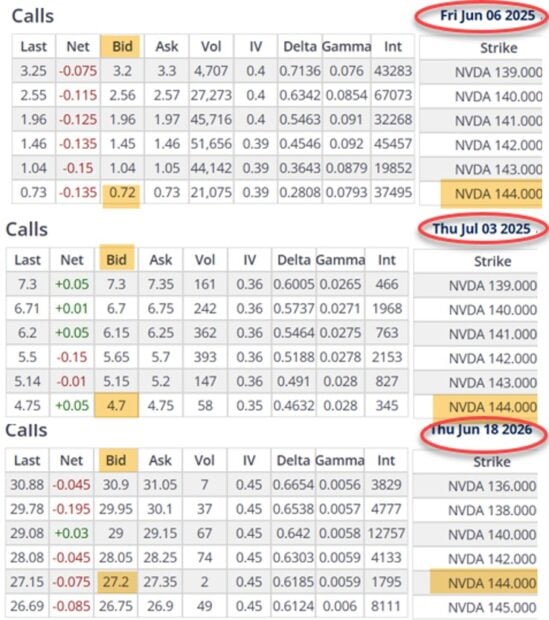

Comparing Weekly, Monthly and Longer-Term Covered Call Expirations Using the Same Strike Price – October 6, 2025

A common misconception made by many retail investors is that they make more money selling longer-dated options because the dollar amount is so much greater than shorter-dated choices. This...

Read More -

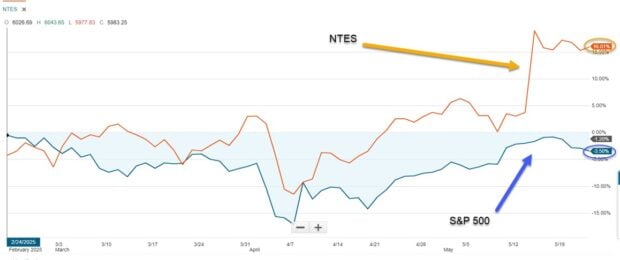

A Defensive 4-Day Cash-Secured Put Trade Start-to-Finish – September 29, 2025

Cash-secured put trades can be crafted conservatively by using deep out-of-the-money (OTM) strikes. On 5/27/2025, I executed such a 4-day trade with NetEase Inc. (Nasdaq: NTES), a stock on our premium...

Read More