-

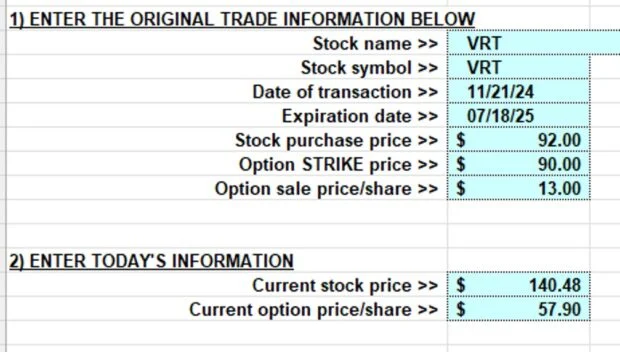

The Collar Strategy Using the BCI Trade Management Calculator + A Sample Trade Video – June 16, 2025

The Collar Strategy is a covered call writing-like strategy where a protective put is added to the trade, thereby establishing a floor and a ceiling with a maximum gain and a...

Read More -

A Real-Life Defensive Weekly Cash-Secured Put Trade with THC + A Sample “Alan Trade” Video – June 9, 2025

Cash-secured put trades can be crafted to be traditional, aggressive or defensive, depending on the degree the put strike is out-of-the-money (OTM). In our BCI methodology, we almost always use OTM put...

Read More -

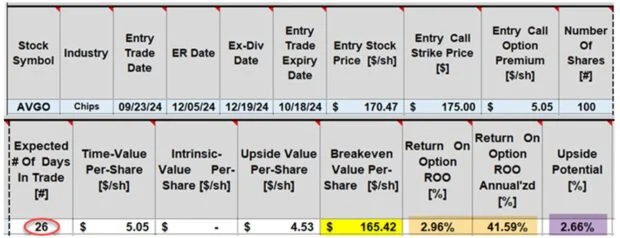

A Real-Life Monthly Covered Call Trade with AVGO – June 2, 2025

Each week, BCI provides our premium members with a sample covered call writing or cash-secured put trade taken from one of Alan’s portfolios or from that of a member....

Read More -

Laddering Covered Call Strikes with CMG – May 27, 2025

When we sell multiple covered call or cash-secured put contracts, we can use numerous strikes to enhance the diversification process. In this article, I will use a real-life example...

Read More -

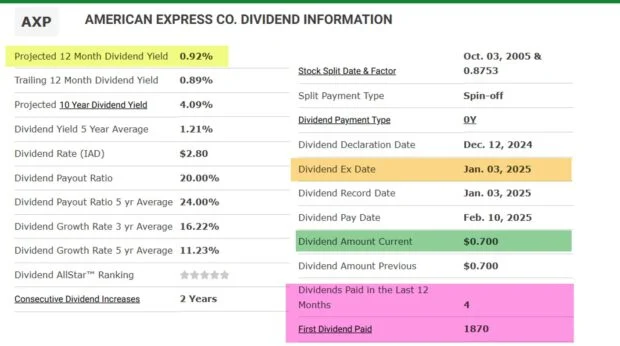

Using In-The-Money Covered Calls Around Ex-Dividend Dates – May 19, 2025

A covered call writing strategy commonly used by hedge funds involves using ITM covered call strikes which expire immediately after an ex-dividend date. This may be appropriate only if...

Read More -

Covered Call Writing Insurance Policies We Pay for and Those that are Free – May 12, 2025

Covered call writing trades can be crafted to be aggressive or defensive. Cautionary approaches include writing in-the-money (ITM) call strikes and adding protective puts to the covered call trades...

Read More -

Calculating Collar Trades Using the BCI Trade Management Calculator (TMC) – May 5, 2025

The Collar Strategy is a covered call writing-like strategy where a protective put is added to the trade, thereby establishing a floor and a ceiling with a maximum gain and a...

Read More -

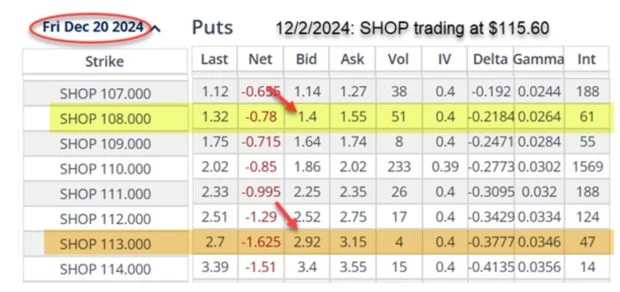

Aggressive and Defensive Cash-Secured Put Trades – April 28, 2025

Much like our covered call writing trades, our cash-secured put trades can also be crafted to be aggressive or defensive. Factors to consider include overall market assessment, chart technical indicators,...

Read More -

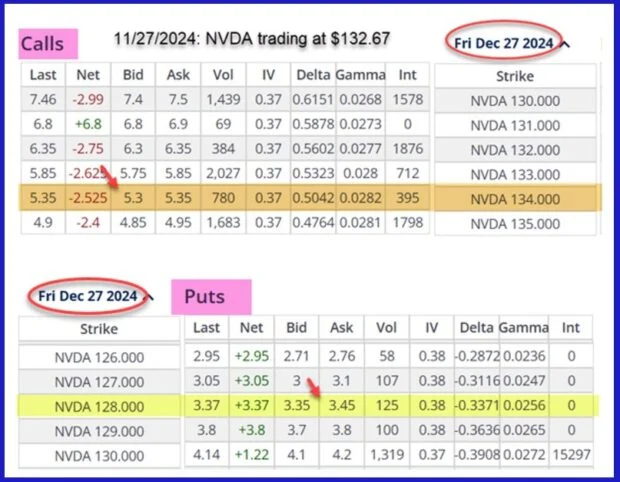

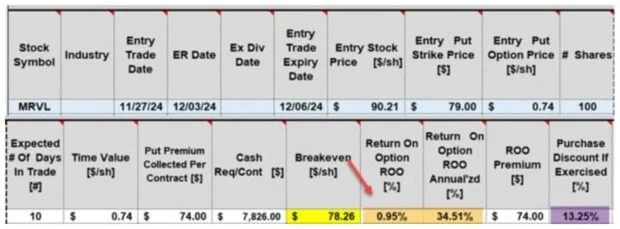

Analyzing and Learning from A Weekly Cash-Secured Put Trade – April 21, 2025

Prior to executing our cash-secured put trades, we must establish our initial time-value return goal range. This will lead us to the most appropriate strike. This article will focus...

Read More -

What is Covered Call Writing Time-Value Cost-To-Close? – April 14, 2025

The success of our covered call writing trades is, to a great extent, dependent on our position management skill set. One of the strategies in our exit strategy arsenal is the mid-contract...

Read More